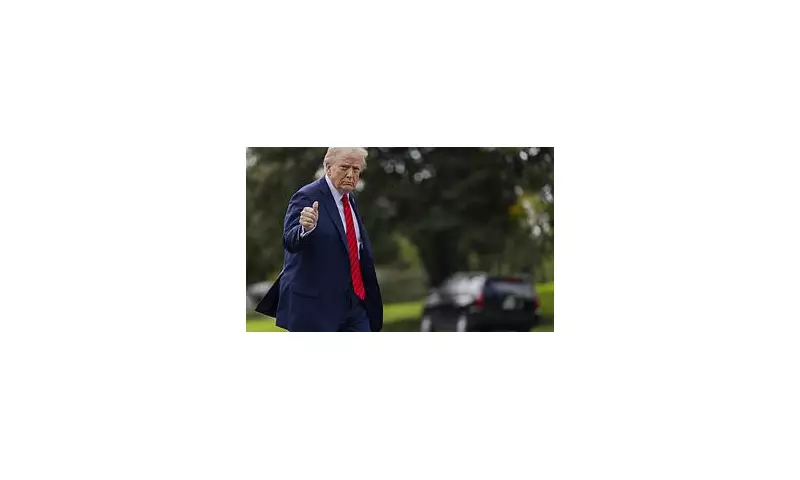

Financial markets were thrown into turmoil today as former President Donald Trump declared a dramatic escalation in the US-China trade war, imposing unprecedented 100% tariffs on all Chinese imports. The announcement sent shockwaves through trading floors worldwide, with London's FTSE and Wall Street's Dow Jones both experiencing sharp declines.

Market Meltdown as Traders Scramble

The tariff bombshell triggered a frantic sell-off across multiple sectors, particularly affecting companies with significant exposure to Chinese manufacturing and supply chains. Technology stocks bore the brunt of the selling pressure, while automotive and retail sectors also saw significant losses.

"This represents the most aggressive trade policy move we've seen in modern economic history," commented leading financial analyst Sarah Chenworth. "A 100% tariff effectively doubles the cost of Chinese goods overnight, which will have catastrophic consequences for both consumers and businesses."

Global Economic Fallout Feared

Economic experts are warning of several immediate consequences:

- Significant price increases for consumer electronics, clothing, and household goods

- Potential supply chain disruptions affecting multiple industries

- Likely retaliation from China targeting American agricultural exports

- Increased inflationary pressure on already strained Western economies

London's Financial Hub Reacts

The news hit London's financial district particularly hard, with banking and investment firms reassessing their global exposure. The timing couldn't be worse for UK markets, already grappling with domestic economic challenges.

"We're seeing panic selling across the board," reported a senior trader at a major City institution. "The scale of these tariffs has caught everyone off guard. This isn't just a trade skirmish anymore - it's becoming an all-out economic war."

What Comes Next?

Analysts predict Beijing will respond with equally aggressive measures, potentially targeting American technology companies and agricultural exports. The move also raises questions about the future of international trade agreements and could accelerate the trend toward regional supply chains.

With economic relations between the world's two largest economies at their lowest point in decades, businesses and investors are bracing for continued volatility and potential long-term restructuring of global trade patterns.