All eyes are on the chipmaker Nvidia as it prepares to release its latest quarterly earnings report, a release that many see as a crucial verdict on the state of the artificial intelligence market.

The Stakes for the World's Most Important Stock

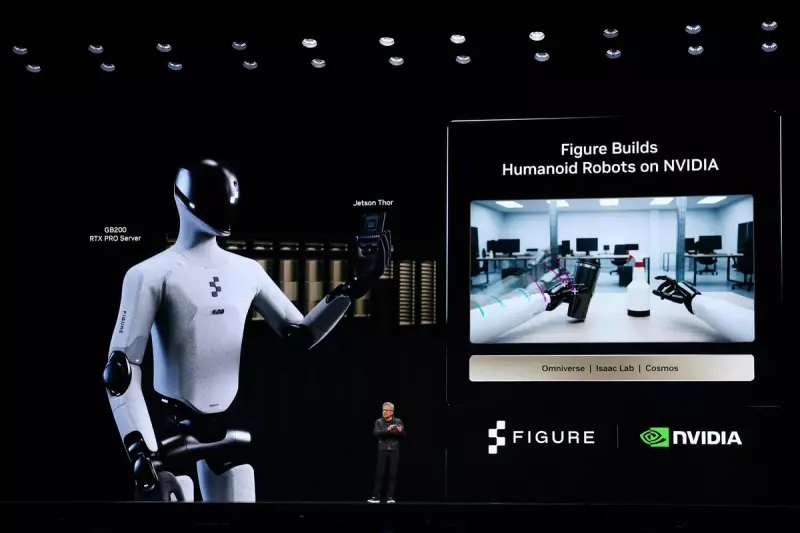

The company's highly specialised chips have become the essential engine powering the AI revolution. This soaring demand has propelled Nvidia to an astonishing market valuation of $4.5 trillion, allowing it to surpass other technology behemoths like Apple and Microsoft.

This growth is reflected in a staggering revenue surge. The company's revenue has skyrocketed from $27 billion in 2022 to a projected $208 billion for this year. This explosive expansion has been largely fuelled by insatiable demand from the world's largest technology firms, all racing to integrate and advance their AI capabilities.

Investor Jitters and the AI Bubble Question

Despite this meteoric rise, investor confidence has recently shown signs of strain. Concerns about a potential "AI bubble" have led to a notable market correction, wiping more than 10% from Nvidia's market value in recent trading.

While financial analysts are still forecasting a strong earnings report, there is a growing sense that Nvidia may need to deliver even more robust growth figures to fully ease the market's anxieties. All attention will therefore be on the commentary from CEO Jensen Huang following the report's release. His words are considered key to either calming market jitters or confirming deeper concerns about the sustainability of the AI boom.

The report is due on Wednesday, 19 November 2025. The tech and financial worlds will be watching closely to see if the results signal a continued boom or the first signs of a bubble set to burst.