Financial markets across Asia posted broad gains on Tuesday, with US stock futures also pointing higher, as investors digested a significant geopolitical development and looked ahead to crucial economic data. The positive momentum followed a strong session on Wall Street, though early trading saw a retreat in oil prices after a sharp spike.

Geopolitical Shockwaves and Market Movements

The weekend capture of Venezuelan President Nicolas Maduro by US forces sent immediate ripples through global commodity markets on Monday. The price of US crude oil jumped 1.7% to $58.32 a barrel, while Brent crude rose by the same margin to $61.76. However, by Tuesday, both benchmarks had pulled back slightly, with US crude shedding 18 cents to $58.14 and Brent losing 14 cents to $61.62.

The event triggered a surge in energy company shares on Wall Street, with Chevron soaring 5.1%, Exxon Mobil rising 2.2%, and Halliburton surging an impressive 7.8%. This rally was fuelled further by reports that former President Donald Trump had suggested a plan for US oil firms to assist in rebuilding Venezuela's decimated oil industry, which has suffered from years of neglect and sanctions.

Asian Markets Rally on Tech and Broader Confidence

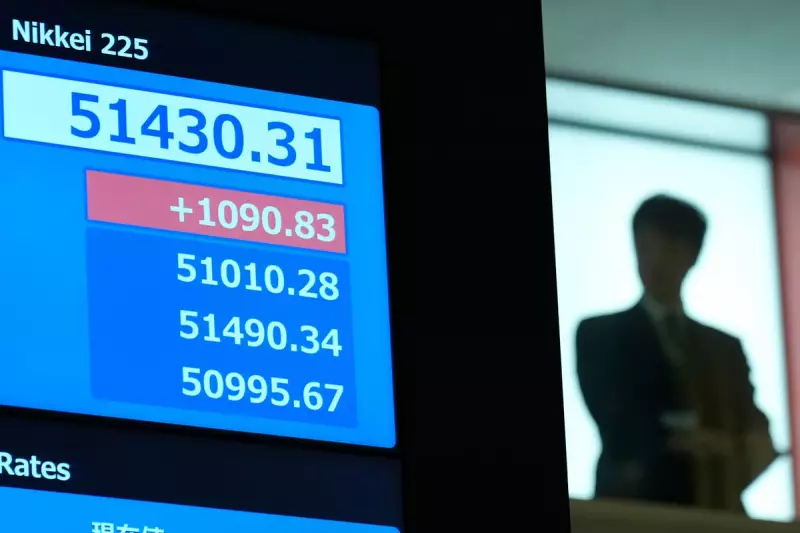

Building on Wall Street's lead, Asian shares advanced strongly. Japan's Nikkei 225 index climbed 1.1% to 52,389.63, driven by robust buying of tech-related shares. Precision tools maker Disco Corp. saw a notable 5.3% jump. South Korea's Kospi gained 0.8% to a record 4,495.49, supported by automakers and electronics manufacturers.

In Greater China, Hong Kong's Hang Seng index surged 1.8% to 26,815.75, while the Shanghai Composite rose 1.1% to 4,069.38. Taiwan's Taiex climbed 1.2%. The performance was not uniformly positive, however, as Australia's S&P/ASX 200 slipped 0.4% and India's Sensex edged 0.1% lower.

US Economic Data and Fed Policy in Focus

Investors are now turning their attention to a slate of upcoming US economic reports that will influence Federal Reserve policy. On Monday, data showed the US manufacturing sector continued to contract in December. The more critical update will come on Wednesday with the ISM's services sector report, which constitutes the bulk of the American economy.

Later in the week, job market data covering openings and overall employment will be a primary focus for the Fed. The central bank is carefully balancing signs of a slowing labour market against persistent inflation risks. After cutting its benchmark rate three times in late 2025, the Fed has become more cautious as inflation remains above its 2% target. Wall Street widely expects the Fed to hold rates steady at its upcoming January meeting.

In other market movements, the US dollar softened slightly against the Japanese yen, while the euro gained ground. Safe-haven assets like gold and silver continued their ascent, with gold adding 0.6% after a 2.8% jump on Monday, and silver rising another 2.7%. Meanwhile, Bitcoin fell back 1.5% to $93,700 after reaching its highest level since mid-November.