Asian Markets Show Divergent Paths After US Rally

Shares across Asia presented a fragmented picture on Tuesday, reacting to a significant rally on Wall Street that was powered by growing anticipation of an interest rate reduction from the Federal Reserve. While some major indices saw modest gains, others traded flat or experienced declines, creating a cautious atmosphere among investors.

This mixed performance in Asia comes directly after US markets enjoyed one of their best sessions since the summer. The S&P 500 climbed 1.5% to 6,705.12, while the Dow Jones Industrial Average rose 0.4% to 46,448.27. The tech-heavy Nasdaq composite saw the most substantial jump, gaining 2.7% to close at 22,872.01.

Regional Performance and Key Movers

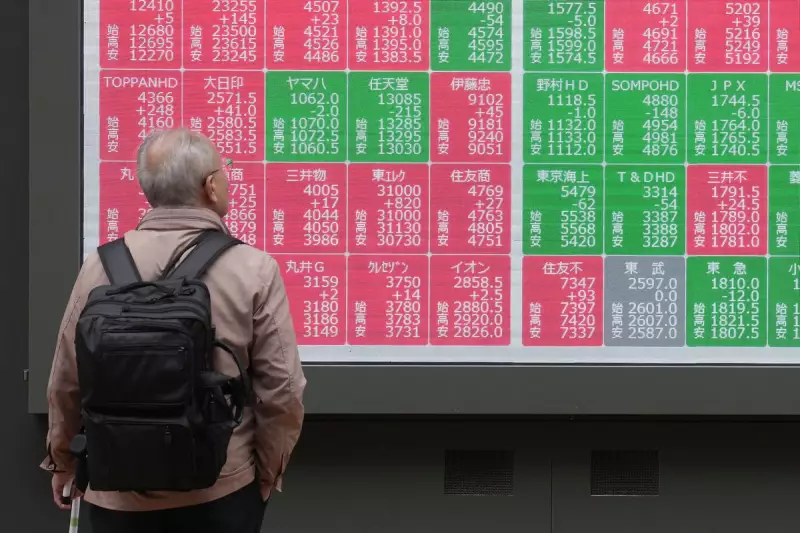

In Japan, the Nikkei 225 edged up less than 0.1% to 48,644.92 after reopening from a holiday. South Korea's Kospi remained nearly flat, trading at 3,848.00. More positive momentum was seen in Greater China, where Taiwan's Taiex rose 1.4% and mainland indices advanced strongly. The Shanghai Composite index jumped 1.1% to 3,880.22, and Hong Kong's Hang Seng climbed 0.6% to 25,875.36.

Market attention was on e-commerce titan Alibaba, which saw its shares gain 2.4% ahead of its earnings report scheduled for late Tuesday. In contrast, Australia's S&P/ASX gave up 0.2%, settling at 8,510.30.

Drivers Behind the Wall Street Surge

The powerful rally on Wall Street was primarily fuelled by two key factors. Firstly, investors are increasingly betting that the Federal Reserve will implement another interest rate cut at its next meeting in December. According to data from CME Group, traders are now pricing in a nearly 85% probability of a rate cut next month, a significant increase from 71% just last Friday.

Secondly, stocks connected to the artificial intelligence boom displayed remarkable strength. Alphabet rallied 6.3%, becoming a major force lifting the S&P 500, following positive reception for its newest Gemini AI model. Chipmaker Nvidia, another AI beneficiary, rose 2.1%.

This surge provided some relief after weeks of sharp market swings driven by uncertainty over the Fed's interest rate path and concerns about a potential bubble in AI-related investments. Despite recent volatility, the S&P 500 remains within 2.7% of the record high it set last month.

Critical Tests Lie Ahead for Markets

The market's optimism faces several crucial tests this week. A major focus will be the release of US wholesale inflation data for September on Tuesday. Economists forecast it will show a 2.6% rise in prices from a year earlier, matching the August figure.

A higher-than-expected reading could deter the Fed from cutting rates in December, as lower borrowing costs have the potential to worsen inflation. Some Fed officials have already voiced opposition to a December cut, arguing that inflation has stubbornly remained above their 2% target.

In other market movements early Tuesday, US benchmark crude oil lost 28 cents to $58.56 per barrel, while Brent crude shed 33 cents to $62.39. The dollar fell slightly against the yen to 156.81, and the euro slipped to $1.1517. Bitcoin continued its recent decline, falling 1.1% to $88,200, a notable drop from its peak near $125,000 last month.

US markets are scheduled to be closed on Thursday for the Thanksgiving holiday, with trading expected to be thin ahead of the Black Friday and Cyber Monday retail rush.