Whitehall is bracing for a potential fiscal earthquake as Treasury mandarins secretly draft sweeping tax reforms that could be unleashed following the next general election.

The Stealth Raid Blueprint

According to explosive documents obtained by the Daily Mail, senior officials are preparing what critics are calling a "double whammy" of revenue-raising measures targeting both pension pots and family inheritances. The plans are being developed as ready-to-implement options for an incoming government.

The pension proposal represents a particular concern for middle-class savers. Officials are examining ways to tax the 25% tax-free lump sum that retirees can currently withdraw from their pension funds. This move would fundamentally alter retirement planning for millions of Britons who have relied on this tax relief for decades.

Inheritance Tax in the Crosshairs

Simultaneously, Treasury strategists are dusting off controversial plans to reform inheritance tax, potentially replacing the current system with a simpler but broader capital gains tax applied to assets passed on after death. This could significantly increase the tax burden on families seeking to preserve wealth across generations.

One Whitehall source revealed: "The work is being done now so it's ready to go. It means any new chancellor could hit the ground running with these reforms if they choose."

Political Firestorm Erupts

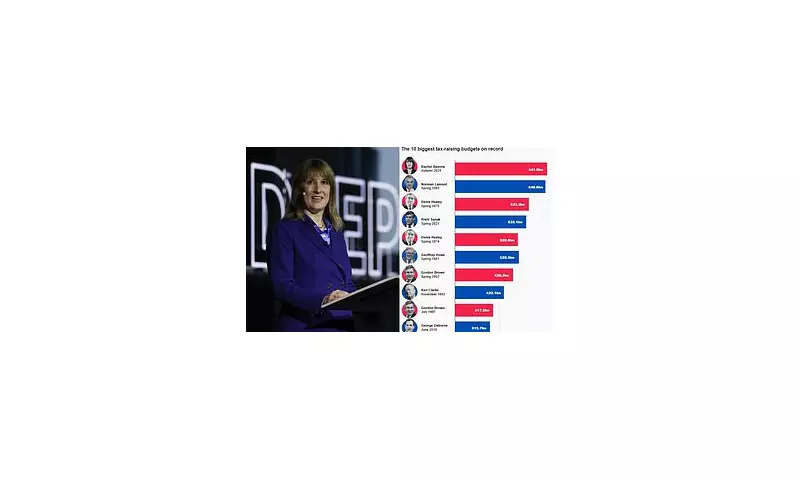

The revelations have ignited a political storm, with Conservative MPs accusing Labour of planning a "great British pensions grab" despite Rachel Reeves' repeated promises of no major tax increases beyond her previously announced policies.

Labour sources have been quick to distance themselves from the specific proposals, emphasising that "Rachel Reeves has been clear that there will be no tax increases beyond those we have already set out". However, the existence of the Treasury documents suggests officials are preparing for potential radical shifts in fiscal policy.

Business and Pensioner Backlash

Business leaders and pensioner advocacy groups have expressed alarm at the proposals. The potential changes to pension taxation could disproportionately affect those who have planned their retirement around the existing tax-free allowances.

Meanwhile, inheritance tax reforms threaten to create additional complexity and uncertainty for families engaged in estate planning. The timing is particularly sensitive given the current cost-of-living crisis and housing market pressures.

As the political battle lines harden, these Treasury preparations ensure that tax policy will remain at the forefront of the coming election campaign, with millions of voters' financial futures potentially hanging in the balance.