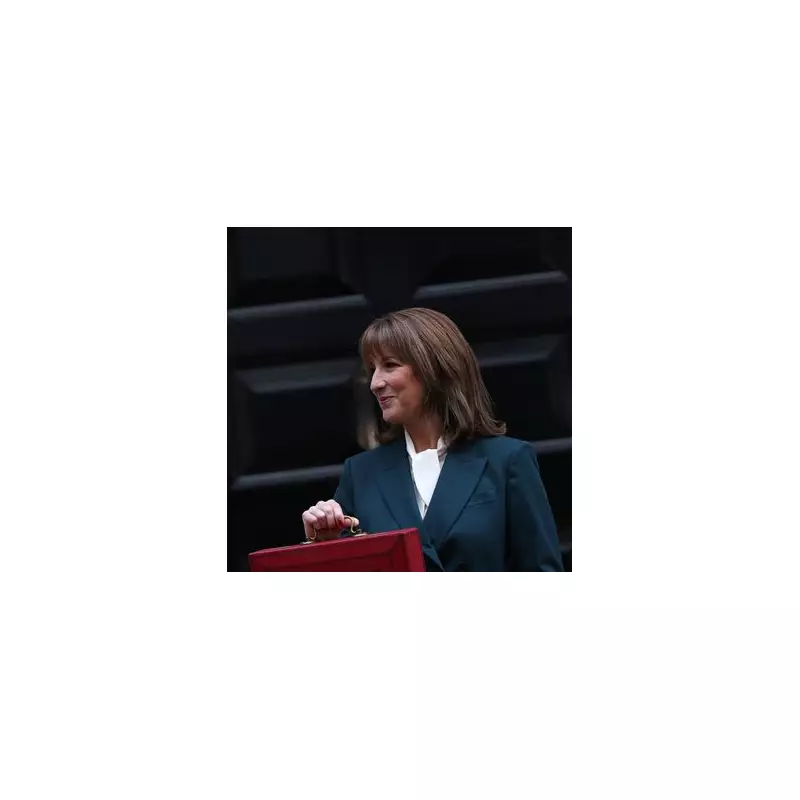

Chancellor Rachel Reeves has unveiled her Autumn Budget for 2025, introducing significant financial changes that will particularly affect younger generations across the UK.

Tax Changes and Savings Impact

The freeze on personal income tax allowance will continue until the end of the 2030/31 financial year. This measure represents a stealth tax increase for millions, as wage growth will push more workers into paying income tax over the coming years.

In a major shift for younger savers, the annual limit for Cash Individual Savings Accounts (ISAs) is being substantially reduced. The allowance drops from £20,000 to £12,000 specifically for younger people, limiting their ability to accumulate tax-free cash savings.

Pension Reforms and New Charges

Starting in April 2029, a new £2,000 yearly cap will apply to pension savings made through salary sacrifice schemes that remain exempt from National Insurance. Contributions exceeding this threshold will become subject to National Insurance, a move expected to generate approximately £4.7 billion for Treasury coffers.

The existing Soft Drinks Industry Levy is expanding to include milkshakes, pre-packaged coffees, and beverages with lower sugar content. Manufacturers have until January 2028 to reformulate their products to reduce sugar levels or face new charges that will likely increase prices for consumers.

Transport and Cost of Living Measures

Motorists face significant changes as the 5p fuel duty cut will only be temporarily maintained before the overall fuel duty freeze ends. This policy shift will lead to gradual increases in petrol and diesel prices across the United Kingdom.

Electric and hybrid vehicle owners will encounter new costs starting in 2028 with the introduction of a pay-per-mile road tax. Additionally, electric cars in London will lose their Congestion Charge exemption from 2026, requiring drivers to pay £13.50 to enter the zone.

Some positive news comes through wage increases and price freezes. The National Living Wage for workers over 21 rises to £12.71 per hour from April, providing an estimated £900 annual boost for low-paid staff. Younger workers aged 18-20 will see their National Minimum Wage increase to £10.85 per hour.

Regulated train fares in England will be frozen until March 2027, marking the first time in three decades they've remained unchanged. The cost of NHS prescriptions in England also stays fixed at £9.90 for the second consecutive year.