Petition Delivered to Treasury Demanding Action on Wealth Inequality

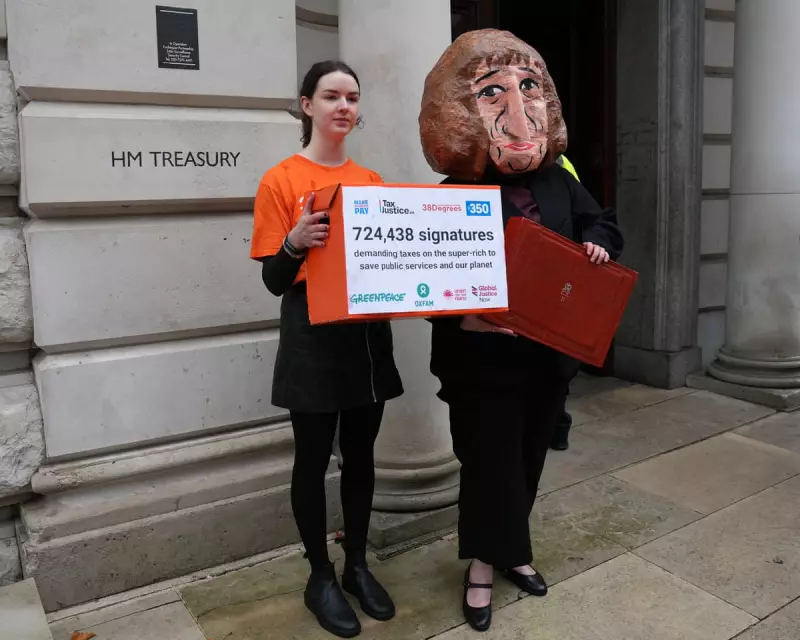

A coalition of organisations including Tax Justice UK and Make Them Pay delivered a significant petition to the Treasury on 19 November 2025, directly calling on the chancellor to implement taxes targeting the super-rich in the upcoming budget. This move has ignited a fierce public debate about wealth, power, and fairness in modern Britain, with compelling arguments emerging from both sides.

The Case For a Wealth Tax: Simple, Fair and Necessary

Responding to an article by Aditya Chakrabortty that dismissed a 1% levy on the super-rich as insufficient, readers and campaigners have mounted a robust defence of wealth taxation. Priya Sahni-Nicholas, Co-director of the Equality Trust, challenged the characterisation of the estimated £10 billion per year that a 1.12% wealth tax on assets over £10 million could raise. She emphasised that this sum is far from trivial, noting that the government recently attempted to push through disability benefit cuts to save roughly half that amount, which would have plunged hundreds of thousands into poverty.

Proponents argue that an annual wealth tax should not be viewed in isolation. Groups like Tax Justice UK estimate that new taxes on wealth and pollution could collectively raise up to £60 billion annually. These funds, they suggest, should be used to redistribute wealth through investments in co-ops, returning assets to public ownership, and building council homes.

Beyond mere revenue, campaigners see a wealth tax as a crucial tool for curbing the influence of the billionaire class. The staggering fact that the wealth of British billionaires has grown by more than 1,000% since 1990 highlights a rapid concentration of power that many find corrosive to society. Citing American labour economics professor Marshall Steinbaum, they believe that a combination of a 2% wealth tax and inheritance taxes could significantly reduce such extreme wealth within 20-30 years.

A Political Imperative in a Dangerous Climate

Another powerful argument frames the wealth tax not just as economic policy, but as an essential political statement. Clare Burton from Shipley, West Yorkshire, warns that with people's lives deteriorating and established political parties failing to offer solutions, the public is becoming vulnerable to simplistic narratives, such as those promoted by Reform UK which blame immigration for the nation's problems.

In this context, the call for a wealth tax serves as a simple, powerful counter-narrative. It clearly states the intent to reverse the flow of money to the rich and redistribute it downwards to improve lives for the majority. It is a formula that fits in a tweet and can effectively communicate a commitment to systemic change where complex economic arguments might fail.

Targeting the Truly Wealthy: A Question of Focus

While agreeing that a 1% tax is insufficient, some readers questioned Chakrabortty's proposed alternative of a "giant raid" on "well-to-do families" with assets over £1 million. Shannon Ray from Totnes, Devon, expressed confusion over this approach, pointing out that there are 150-odd billionaires and thousands with over £100 million in the UK.

The more logical and politically palatable solution, they argue, is to focus on this tiny minority with truly extraordinary wealth, taxing them at 10% or more. This would raise substantially more revenue without alienating the much larger group of asset-holders who are not super-rich. This perspective underscores the strategic importance of precisely defining the target of any proposed wealth tax.