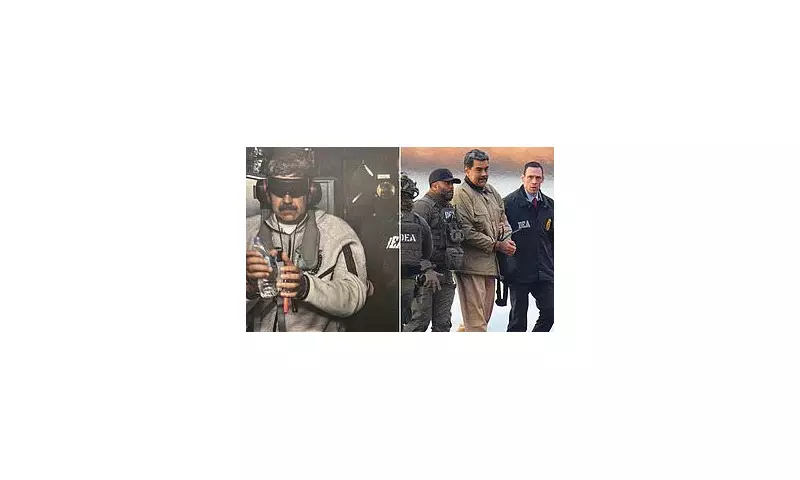

A mysterious trader has netted a staggering $400,000 profit after placing a cryptocurrency wager on the removal of Venezuelan President Nicolás Maduro, mere hours before US forces captured him in a dramatic raid on his Caracas residence.

The High-Stakes Bet and Dramatic Capture

Data from the prediction market platform Polymarket reveals the trader built positions in contracts tied to Maduro's ousting. These contracts, implying long odds, were worth approximately $34,000 just before the weekend operation. Their value skyrocketed following news of "Operation Absolute Resolve," the US military mission that resulted in the Venezuelan leader's seizure.

The anonymous account was created last month, with the trader initiating the strategy by purchasing $96 worth of contracts on December 27. These contracts were set to pay out if the US invaded Venezuela by January 31. Several similar bets were placed in the subsequent days, culminating in the massive windfall after Maduro's capture on Saturday, January 3, 2026.

Market Turmoil and Political Fallout

The geopolitical shockwave triggered immediate financial reactions. Major stock indexes and oil prices climbed on Monday, while energy shares posted significant gains. Venezuela's default-ridden government bonds surged on hopes of a major debt restructuring. Bonds issued by the state and its oil firm, PDVSA, jumped by as much as 10 cents on the dollar, a rise of nearly 30%.

The lucrative trade is now expected to draw intense scrutiny from US lawmakers. Democratic Congressman Ritchie Torres announced plans to introduce a bill this week aimed at banning elected officials, lawmakers, and federal employees from betting on prediction markets where they might access material non-public information. This follows a broader bipartisan push for stricter insider trading rules.

Legal Proceedings and Platform Scrutiny

Following his capture, Maduro and his wife, Cilia Flores, 69, were transported to New York. At a defiant court appearance on Monday, January 5, the 63-year-old president pleaded not guilty to charges including narco-terrorism, conspiracy, drug trafficking, and money laundering. Flores also pleaded not guilty to related charges. A federal judge ordered them detained, with a hearing set for March 17.

The incident has cast a renewed spotlight on Polymarket and prediction markets at large. These platforms allow users to trade yes-or-no contracts on real-world events, from politics to sports. Contracts priced at a few cents can pay out at $1, enabling huge profits for those with advance knowledge. The US Commodity Futures Trading Commission (CFTC), which approved Polymarket's relaunch last September, did not immediately comment on whether it is investigating the Maduro-related trades.

While the main Polymarket platform is not accessible to users in the US, many traders reportedly use VPNs to circumvent the restriction. The platform itself has faced previous questions over potential insider trading on its site.