A leading cryptocurrency-based prediction market is facing intense scrutiny from United States lawmakers for permitting users to place direct financial bets on active wars and potential geopolitical conflicts.

Senators Sound Alarm on National Security Threat

In a significant escalation, a bipartisan group of 12 US Senators has written to the incoming chairman of the Commodity Futures Trading Commission (CFTC), Michael Selig. They argue that the platform's activities are not only potentially illegal but also represent a clear danger to national security. The letter, sent on Sunday, contends that federal law "expressly prohibits" the types of contracts offered by Polymarket.

"If prediction market contracts that implicate military operations or other national security considerations are manipulated by insider information, or even listed, it is possible for foreign adversaries to use this to their advantage," the senators warned.

Multi-Million Dollar Wagers on Global Conflict

The controversy centres on a series of new contracts introduced on Polymarket in recent weeks. These allow users to gamble with cryptocurrency on the likelihood of severe geopolitical events. Specific markets cited include:

- A potential Chinese invasion of Taiwan.

- Further Russian territorial gains in Ukraine.

- US military action in countries such as Colombia and Cuba.

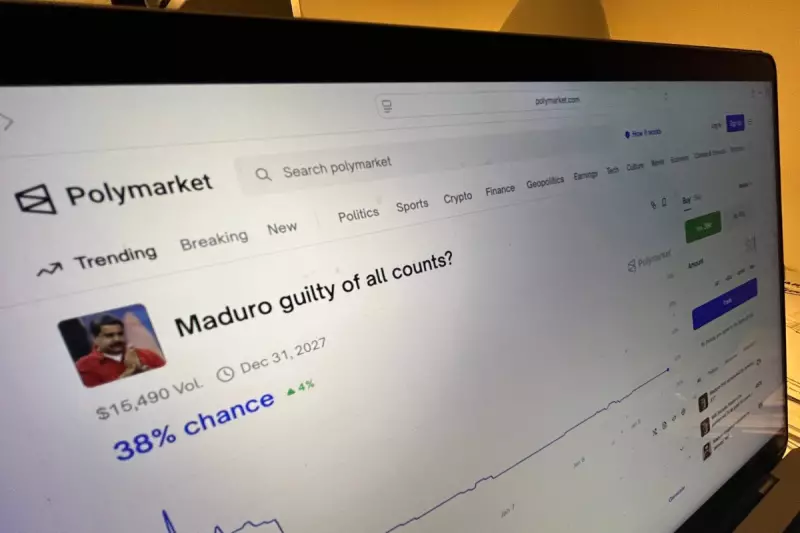

According to data from Bloomberg, betting contracts related to possible US military intervention in Iran alone have generated over $18 million in trading volume. The senators highlighted a particularly concerning case reported by The Wall Street Journal, where one trader won more than $400,000 after correctly wagering that Venezuelan leader Nicolás Maduro would be ousted.

"This improbable increase in trades against Maduro’s continued authority in Venezuela mere hours before Maduro’s capture exemplifies the dangers of unregulated gaming and raises national security concerns," the lawmakers wrote.

Regulatory Crackdown Proposed but Not Enacted

The situation unfolds against a backdrop of stalled regulatory action. Back in 2024, the CFTC proposed rule changes specifically designed to crack down on betting markets centred on "harmful" geopolitical events, explicitly naming terrorism, assassination, and war. The regulator argued that such bets were "at a base level, is offensive" and could incentivise real-world atrocities by allowing perpetrators to profit financially.

However, these proposed rules were never finalised, leaving a regulatory grey area that platforms like Polymarket continue to operate within. The Independent has contacted both the CFTC and Polymarket for comment.

Polymarket appears cognisant of the ethical dilemmas. A disclaimer on its site regarding Middle East contracts states its belief in using "the wisdom of the crowd to create accurate, unbiased forecasts for the most important events to society." It argues that in turbulent times, prediction markets can provide answers that traditional news media cannot.

Not all prediction platforms are willing to tread this path. Competitors like Kalshi Inc. have publicly stated they avoid war-related markets entirely. A Kalshi spokesperson told Bloomberg, "Kalshi avoids markets based on war altogether due to the extremely harmful incentives they can create," focusing instead on political event contracts like whether a global leader will leave office by a certain date.