Ocado, the British online grocery and technology group, has faced another significant setback in its North American operations after its Canadian retail partner Sobeys announced the closure of a key robotic warehouse facility. This development sent Ocado's share price tumbling by approximately ten percent during Thursday morning trading, reflecting investor concerns over the firm's international expansion strategy.

Canadian Warehouse Closure Follows US Setbacks

The announcement from Sobeys comes just months after a major US grocery chain, Kroger, decided to shut three Ocado-run warehouses and abandon plans for a new site in North Carolina. These consecutive blows have raised questions about the pace of growth in the North American online grocery market and Ocado's ability to navigate regional challenges.

Ocado informed investors that Sobeys, Canada's second-largest food retailer, is closing its customer fulfilment centre in Calgary due to slower-than-anticipated growth in the local grocery e-commerce sector. The two companies originally signed a partnership agreement in 2018 to launch an online grocery business utilising Ocado's advanced automation technology platform.

Partnership Continues Despite Calgary Closure

Despite this closure, Ocado emphasised that Sobeys will continue operating two remaining robotic warehouses located in Ontario and Montreal to support its online grocery operations. The Calgary facility represented the third warehouse to open under the partnership, which has now been scaled back in response to market conditions.

Tim Steiner, Ocado's chief executive, described the Sobeys decision as reflecting a "pragmatic approach to refining the network" and acknowledged that certain parts of the market had "not developed as anticipated." He positioned the changes as part of a strategic reset for Ocado's North American business, stating that the company's technology has evolved significantly since its initial customer fulfilment centres launched in the region.

Technology Business Faces Market Pressures

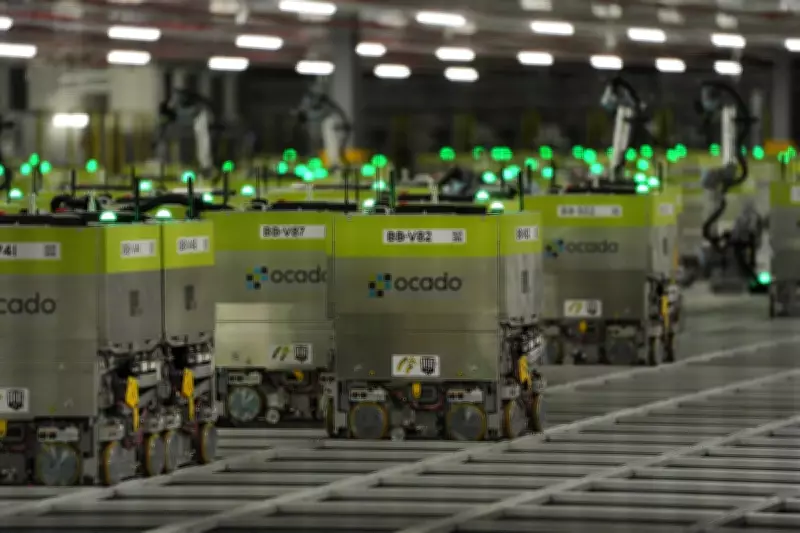

The Hertfordshire-based company operates two distinct business models: it sells sophisticated automation technology that enables retailers to pick and dispatch online food orders from massive robotic warehouses, while simultaneously running a UK online grocery firm as a joint venture with Marks & Spencer. The technology division, which includes partnerships with international retailers like Sobeys and Kroger, represents a crucial growth avenue for the company.

Following the Sobeys announcement, Ocado shares experienced a sharp decline, continuing a pattern of volatility that began late last year when Kroger revealed its warehouse closures. Despite these setbacks, Ocado continues to operate five sites for Kroger and supports its logistics operations, indicating that the partnerships remain active albeit on a revised scale.

Strategic Reset for North American Operations

Steiner framed the recent developments as creating opportunities for future growth, suggesting that the revised partnerships with both Sobeys and Kroger place Ocado in a stronger position for long-term success. He noted that these changes "reopen a substantial market for Ocado's much evolved technology," indicating confidence that the company's refined automation systems will find renewed demand in North America despite current challenges.

The online grocery market in North America has experienced fluctuating growth patterns since the pandemic-driven surge in e-commerce, with some regions developing more slowly than industry forecasts had predicted. Ocado's experience highlights the complex realities of scaling advanced automation technology across diverse markets with varying consumer adoption rates and logistical challenges.