Scots Face £6,500 Council Tax Hike in SNP Overhaul

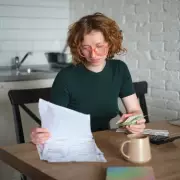

Homeowners across Scotland brace for financial blow as SNP government plans radical council tax overhaul that could see bills increase by up to £6,500 annually under controversial new property valuation system.