Millions of British homeowners are facing a hidden financial timebomb as new data reveals the true scale of flood risk exposure across the country. According to groundbreaking analysis, properties previously considered safe are now being reclassified into higher flood risk categories, triggering dramatic insurance premium increases.

The Shocking Numbers Behind Britain's Flood Risk

Recent analysis indicates that approximately one in four UK homes now fall into the highest flood risk categories used by insurers. This reclassification affects properties that many owners believed were safely outside flood zones, creating a wave of unexpected financial pressure on households already struggling with cost-of-living challenges.

Why Your Insurance Premiums Are Skyrocketing

The insurance industry's flood risk models have undergone significant updates, incorporating more sophisticated climate change projections and historical weather pattern analysis. This means:

- Properties once considered low-risk are being moved into medium or high-risk categories

- Insurance premiums for affected homes have increased by up to 50% in some cases

- Some homeowners are finding it difficult to secure affordable coverage

The Climate Change Connection

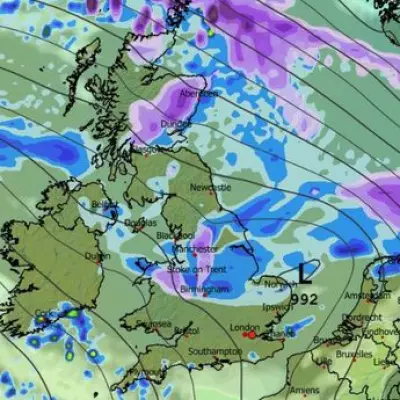

Experts point to climate change as the primary driver behind this reassessment. More frequent and intense rainfall events, combined with rising sea levels, have fundamentally altered the flood risk landscape across Britain. Urban areas with inadequate drainage infrastructure are particularly vulnerable to sudden surface water flooding.

How to Check Your Property's Flood Risk

Homeowners concerned about their property's flood risk status can take several steps:

- Check the Environment Agency's online flood risk maps

- Consult with your current insurance provider about their risk assessment

- Consider obtaining a professional property flood risk assessment

- Research flood resilience measures that might lower your premiums

The Future of UK Property Insurance

Industry analysts predict that flood risk will continue to reshape the UK insurance market, with some suggesting that standard home insurance policies may need to evolve to address the growing challenge. There are increasing calls for government intervention to support homeowners in high-risk areas and incentives for flood resilience improvements.

The message for UK homeowners is clear: understanding your property's flood risk is no longer optional—it's essential financial planning in an era of climate uncertainty.