Former President Donald Trump has initiated a monumental $10 billion lawsuit against the Internal Revenue Service (IRS) and the United States Treasury Department. The legal action, filed in a federal court in Florida, centres on the unauthorised disclosure of his confidential tax records to media outlets during the period from 2018 to 2020.

Plaintiffs and Allegations in the High-Stakes Case

The lawsuit names not only Donald Trump as a plaintiff but also includes his sons, Eric Trump and Donald Trump Jr., alongside the Trump Organization. The filing presents a stark accusation, claiming the leak of sensitive tax information resulted in profound reputational and financial harm. It further alleges the disclosures caused significant public embarrassment, unfairly damaged their business reputations, portrayed them in a false light, and negatively impacted President Trump's public standing, particularly among voters during the 2020 presidential election.

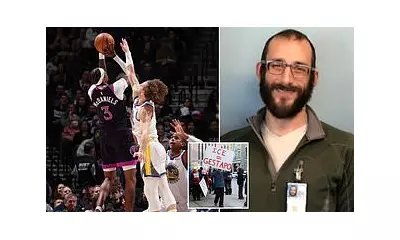

The Source of the Leak: A Contractor's Actions

The legal action follows the conviction of former IRS contractor Charles Edward Littlejohn, also known as 'CHAZ'. Littlejohn, who was employed by the defence and national security technology firm Booz Allen Hamilton, was sentenced to five years in prison in 2024 after pleading guilty to leaking tax information. Court documents reveal he secretly downloaded years of Trump's tax records in 2018 and subsequently provided them to reporters from The New York Times.

This breach led to a series of articles published in 2020, which disclosed that Trump paid no federal income tax in ten out of the fifteen years preceding his election as president. Littlejohn later extended his actions, leaking tax information concerning other ultra-high net worth individuals to the investigative outlet ProPublica. These actions constituted a direct violation of IRS Code 6103, one of the federal government's most stringent confidentiality statutes.

Broader Implications and Contractor Fallout

Littlejohn's defence team stated his motivations stemmed from concerns over economic inequality and a desire to instigate reforms within the US tax system. The data he stole included records of other billionaires, such as Jeff Bezos and Elon Musk, forming the basis for nearly fifty ProPublica articles that examined how the wealthy navigate the tax code.

In a related development, the US Treasury Department recently terminated its contracts with Booz Allen Hamilton. Treasury Secretary Scott Bessent cited the firm's failure to implement adequate safeguards for protecting sensitive taxpayer data accessed through its IRS contracts. This move underscores the severe consequences of the data breach.

Historical Context of Trump's Tax Returns

The lawsuit revisits a longstanding political issue. Donald Trump broke with decades of tradition by refusing to release his tax returns during his 2016 presidential campaign, citing an ongoing audit—a justification the IRS stated held no legal weight for preventing disclosure. Ultimately, six years of his returns were released in 2022 by the then-Democratically controlled House Ways and Means Committee following a protracted court battle.

Current Challenges Facing the IRS

This lawsuit arrives during a period of significant turmoil for the IRS. The agency has undergone substantial workforce reductions, shrinking from approximately 102,000 employees at the start of 2025 to about 74,000 by year's end. These cuts were driven by firings and layoffs initiated by the Department of Government Efficiency (DOGE).

While IRS employees involved in the previous tax season were initially restricted from accepting administration buyout offers, many customer service workers have since departed. In response to these challenges, IRS CEO Frank Bisignano recently announced a reorganisation of the agency's executive leadership and outlined new priorities, expressing confidence in the team's ability to deliver a successful upcoming tax filing season for the American public.

Representatives from the White House, the Treasury Department, and the IRS have not provided immediate comment on the newly filed lawsuit. The case highlights critical ongoing debates surrounding data security, political transparency, and the legal protections for confidential taxpayer information.