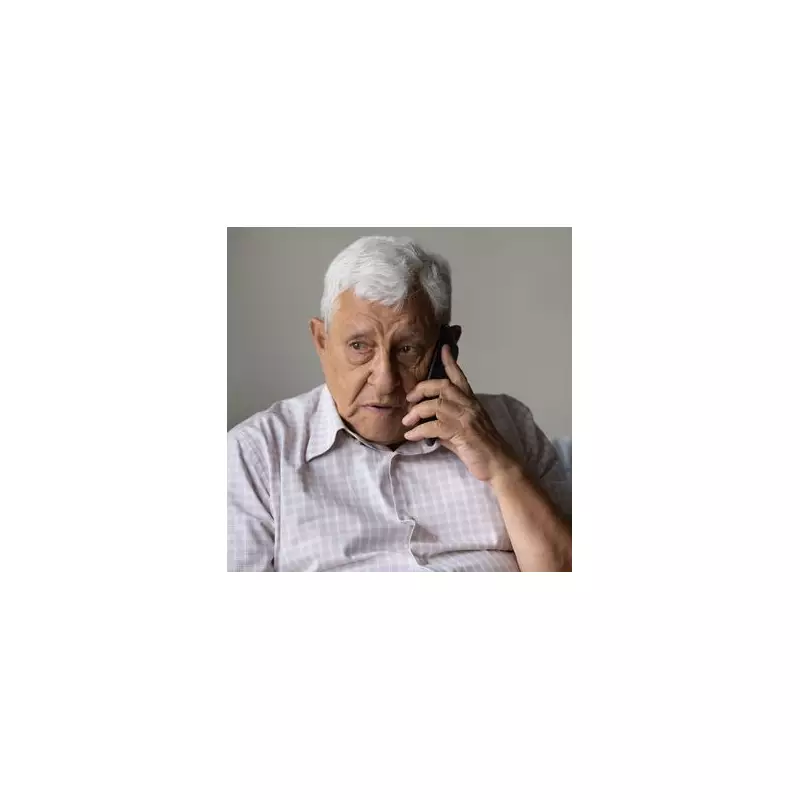

Families across the United Kingdom are being urgently advised to warn their elderly relatives about a particularly cruel telephone scam that is rapidly wiping out people's lifetime savings. This alarming development comes as elder fraud quietly emerges as one of the fastest-growing forms of financial crime in the country, with scammers increasingly targeting older adults who may be more trusting of unexpected communications.

The Growing Threat to Elderly Finances

While many families assume that fraud primarily affects younger people online, experts reveal that criminals are deliberately shifting their attention to parents and grandparents. This strategic move occurs because exploiting trust often proves easier than cracking complex passwords. In the past six months alone, fresh reports linked to so-called 'grandparent' style scams and impersonation fraud have continued to surface nationwide, with victims sometimes losing four-figure sums in a single interaction.

Organised Criminal Operations

The scale of this problem became particularly evident in early September 2025, when the Police Service of Northern Ireland announced an extradition arrest connected to a 'grandparent scam'. This case underlined how organised and cross-border some of these criminal operations have become. Separately, regional police forces have warned about significant spikes in impersonation calls where criminals pose as police officers or bank officials, a tactic that frequently targets older residents by leveraging panic and perceived authority.

Why Scammers Target Older Adults

Mark Baars, a technology expert and Digital Marketing Innovation Manager at Unit4, explains that criminals now view older adults as one of the most attractive groups to exploit. "Older adults are seen as a prime target because they often have stable incomes, decent savings and strong credit histories built up over decades," he stated. "From a scammer's point of view, it's a high-reward opportunity with relatively low effort."

Baars emphasises that many fraudsters rely less on technological sophistication and more on psychological manipulation. "This type of fraud isn't about hacking systems. It's about manipulating trust, authority and urgency," he continued. "If someone believes they're helping a loved one or protecting their savings, they're far more likely to act quickly without proper verification."

Understanding the 'Grandparent' Scam

The 'grandparent' scam represents one of the most common frauds currently circulating via telephone and text message. Criminals typically pose as a grandchild or close relative, claiming to have a new contact number before alleging they are in serious trouble and urgently need money.

"These calls often start with something vague like, 'It's me, I need help'," Mark Baars explains. "Once the scammer establishes an emotional hook, they introduce an urgent problem such as a legal issue, a medical bill or a fine that must be paid immediately."

He notes that criminals frequently instruct victims not to tell anyone about the situation, which significantly increases the psychological pressure. "Secrecy is a huge red flag. Scammers rely on isolation because the moment a second person becomes involved, their fabricated story usually falls apart," he warned.

Additional Fraudulent Tactics

Other increasingly common tactics employed by fraudsters include:

- Fake bank fraud alerts designed to create panic

- Spoofed telephone numbers that appear to originate from trusted institutions

- Emails or text messages crafted to rush recipients into clicking malicious links or transferring money

While the financial losses can be severe, Mark Baars stresses that the emotional impact often proves even more devastating. "Many victims experience deep embarrassment after the fact, even though they've done nothing wrong," he says. "That shame can prevent people from reporting what happened or asking for assistance, which only benefits the criminals."

He adds that losing substantial savings later in life can be particularly catastrophic. "For someone in retirement, there may be no realistic way to rebuild those savings. That's why this type of fraud can have lasting consequences for mental health and personal independence."

Warning Signs Families Should Never Ignore

Mark Baars advises families to pay close attention to behavioural changes, not just financial irregularities. "If an older relative suddenly seems anxious about money, unusually secretive, or mentions urgent payments that don't quite add up, those are significant warning signs," he explains. "Scammers deliberately create panic so people don't have adequate time to think things through rationally."

He also cautions that fraudsters are increasingly impersonating professionals to appear more credible. "We're seeing more cases where scammers pretend to be bank staff, police officers or utility providers. The authority sounds convincing, especially during telephone conversations where visual verification is impossible."

Practical Steps That Genuinely Reduce Risk

According to Mark Baars, prevention begins with communication rather than technological solutions. "Staying connected represents one of the most effective protections available," he asserts. "Regular conversations reduce social isolation and make it easier for older adults to sense when something doesn't feel quite right."

He recommends that families have clear, calm discussions about potential scams before any incidents occur. "Explain that legitimate organisations will never ask for passwords, full PINs or urgent transfers over the telephone. Framing this information as practical guidance rather than fear-based warnings makes it easier to absorb and remember."

Baars also highlights the importance of implementing financial safeguards. "Monitoring bank statements regularly, setting up transaction alerts and naming a trusted contact with financial institutions can create additional layers of protection without removing personal independence," he advised.

As these sophisticated scams continue to evolve and target vulnerable elderly populations, increased awareness and proactive communication within families remain crucial defences against financial exploitation that could devastate retirement savings and emotional wellbeing.