In a blockbuster earnings report that has sent shockwaves through the global technology sector, Nvidia has once again obliterated Wall Street forecasts, cementing its status as the undisputed engine of the artificial intelligence revolution.

The Silicon Valley chipmaking behemoth announced a staggering 156% year-on-year surge in data centre revenue, which rocketed to an eye-watering $26.8 billion (£20.7bn). This monumental growth propelled the company's total revenue for the quarter to $30.5 billion (£23.6bn), vastly exceeding analyst predictions and demonstrating an insatiable global demand for its high-performance processors.

The Engine of the AI Revolution

Nvidia's graphics processing units (GPUs) have become the critical infrastructure underpinning the entire generative AI ecosystem. From training massive large language models like ChatGPT to powering complex AI applications in healthcare and finance, the company's chips are the gold standard. This quarter's figures provide undeniable proof that what many termed an 'AI bubble' is, in fact, a fundamental and accelerating technological shift.

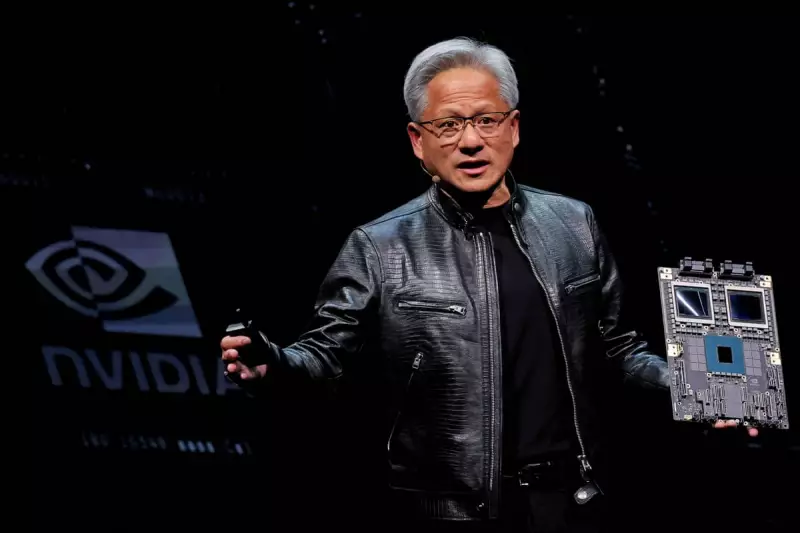

"The next industrial revolution has begun," declared Nvidia's founder and CEO, Jensen Huang. "Companies and countries are partnering with Nvidia to shift the trillion-dollar traditional data centres to accelerated computing and build a new type of data centre - AI factories - to produce a new commodity: artificial intelligence."

Market Euphoria and Future Guidance

The financial markets responded with fervour. Nvidia's stock, a key driver of the S&P 500 and Nasdaq indices, surged in after-hours trading following the announcement. The company's forward guidance was equally bullish, with Nvidia projecting revenue of approximately $33 billion (£25.5bn) for the current quarter, again surpassing analyst expectations.

This performance is not an isolated event but part of a remarkable growth trajectory. The company's revenue has skyrocketed from just $3.2 billion in the same quarter two years ago, representing a nearly tenfold increase and highlighting the breathtaking speed of the AI adoption cycle.

Sustaining the Momentum

While the results are extraordinary, questions remain about how long this explosive growth can be sustained. Nvidia faces challenges, including heightened competition from rivals like AMD and Intel, its own ability to meet overwhelming demand, and potential shifts in regulations governing chip exports to China.

Nevertheless, with its new Blackwell chip platform now in full production and demand far outstripping supply, Nvidia's reign at the summit of the tech world looks secure for the foreseeable future. Its earnings are more than just numbers on a spreadsheet; they are the most reliable barometer for the health and direction of the entire artificial intelligence industry.