A business owner from the Scottish Highlands has reclaimed an estimated 40 hours of her time each year after ditching manual bookkeeping for a digital tax system, a simple change she discovered through a social media post.

From Panic to Peace of Mind

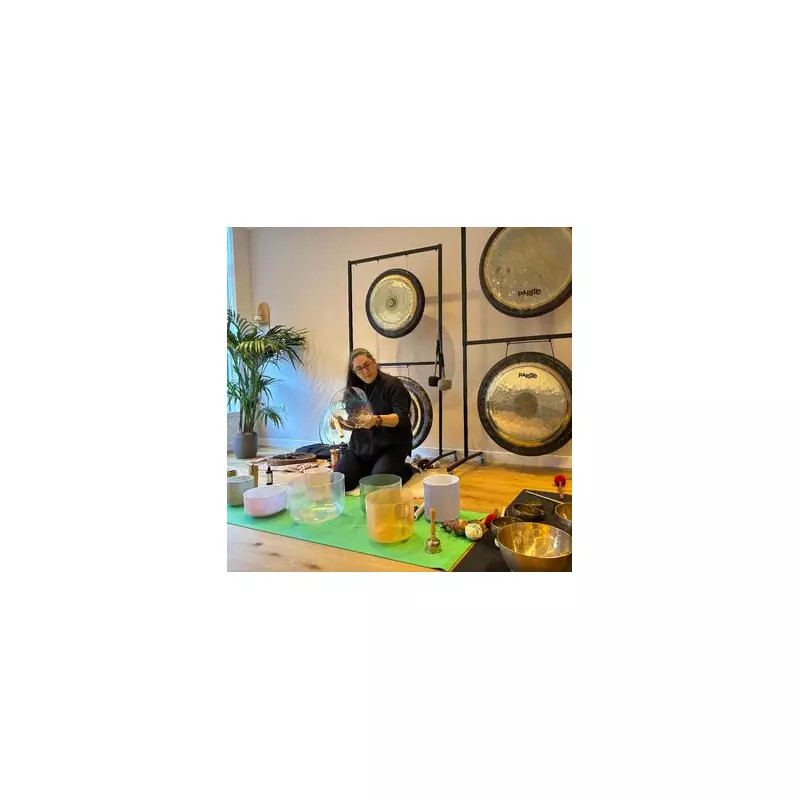

Helene Fleming, who has run a holistic health business since 2008, initially "freaked out" upon learning about the mandatory introduction of Making Tax Digital (MTD) for Income Tax. The new system, set for rollout in April 2026, will require sole traders and landlords with a gross income over £50,000 to maintain digital records and submit quarterly updates.

"I used to do all my tax returns by hand," Helene explained. "I’d sit down a couple of times a month and work out my totals, which took around three hours monthly, plus a half-day at the year's end. It was very time-consuming and took valuable time away from my business."

The Social Media Tip-Off

Her journey to efficiency began unexpectedly in June of this year when she spotted a post on Facebook asking, ‘Are you ready for MTD for Income Tax?’. Her reaction was one of immediate concern. "My answer was, ‘Absolutely not - does this apply to me?’," she recalled. After researching, she realised that while it didn't apply to her immediately, it would in the future, prompting her to get ahead of the curve.

Helene's experience is common. New research from technology firm Sage reveals that almost 70% of sole traders still complete their Self-Assessment tax return manually, with one in three using pen and paper. Furthermore, the research indicates that only 30% of businesses are currently aware of the impending MTD for Income Tax changes, despite the rollout being just five months away.

Minutes, Not Hours

After taking the plunge, Helene found the transition straightforward. She now uses accounting software to log transactions in minutes. "If somebody pays me, I just put it in the app and it's done," she said. "The time I’ve got back is precious, because as a sole trader I don't have enough hours in the day. I’ve also gained peace of mind knowing the software handles the sums correctly."

She highlights the benefits of features like bank reconciliation, which eliminates hours of cross-referencing bank statements and calendars. "You just enter it, and it takes you 30 seconds. You don't even have to reach for your physical books," Helene added.

Now, Helene is on a mission to empower other sole traders. She advises those who are unaware or worried about MTD to try a free accounting tool. "They could always keep doing their books in their original manner as well, and if they don't like it, hop off. But honestly, I think when people taste it, they will not want to go back," she stated.

For Helene, the switch has been transformative, clawing back the equivalent of a full working week annually—time she can now invest directly back into growing her Highland business.