The dramatic tale of a telecommunications tycoon who soared to become Los Angeles's wealthiest individual, only to die deeply in debt after an obsessive and extraordinarily costly renovation of a historic mansion, has emerged through court documents and reports.

From Billionaire Heights to Financial Catastrophe

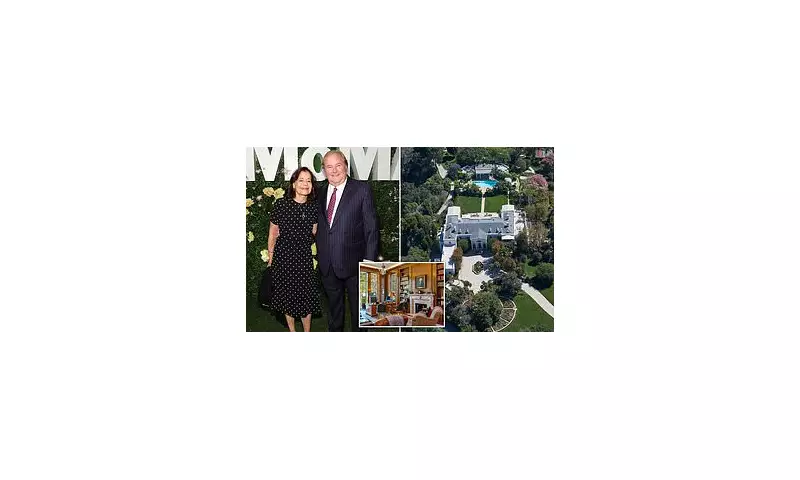

Gary Winnick, the founder of the fibre-optic network Global Crossing, saw his fortune peak at an estimated $6.2 billion. This immense wealth allowed him and his wife, Karen, to acquire the legendary Casa Encantada estate in Bel Air for $94 million in 2000, setting a US record for the most expensive home sale at the time.

An admirer of Great Gatsby-style grandeur, Winnick embarked on a near-three-year restoration project overseen by star architect Peter Marino. The scale was staggering: more than 250 skilled tradespeople were employed. This team included eight artisans brought from Paris solely to lacquer wood walls and plaster craftsmen who had worked on the Bellagio Hotel in Las Vegas.

The goal was museum-level perfection. Winnick tracked down original furniture designed for the 1930s mansion at "great expense" and filled it with historic art, including a portrait of George Washington commissioned by Benjamin Franklin. The total spend on the purchase and renovation reportedly approached a quarter of a billion dollars.

A Lavish Lifestyle Built on Shifting Sands

Winnick's opulence extended far beyond the mansion's walls. He was known for picking up the cheque for large groups at lavish restaurants, ordering every menu item. He hosted political fundraisers and charitable events for institutions like the Museum of Modern Art, donated millions to the Los Angeles Zoo, and maintained ties with figures like President Bill Clinton.

His generosity was legendary; he once gave company stock to his longtime housekeeper, making her a millionaire. Alongside Casa Encantada, the couple owned a New York apartment redone by another star architect and a Malibu beach house.

However, this glittering facade hid severe financial strain. Global Crossing collapsed in 2002 after the dot-com bubble burst, though Winnick had cashed out $730 million in stock beforehand, leading to a $55 million settlement from shareholder lawsuits. He became a serial investor in failing startups, and for over two decades, he struggled with cash flow despite maintaining the appearance of vast wealth.

The Final, Fateful Loan and a Widow's Legal Fight

The crisis culminated in 2020 when Winnick, then 76, secured a $100 million "loan-to-own" loan from the CIM Group, led by his longtime friend Richard Ressler. He put up Casa Encantada (then valued at $250 million), the Malibu home, and an array of family possessions—including artwork and his wife's wedding ring—as collateral.

According to a Wall Street Journal report, the loan's variable interest rate never fell below 9.55%, and it has since ballooned to over $155 million. Winnick died in 2023 with more than $150 million in debt.

His widow, Karen Winnick, 79, claims she was kept in the dark about their finances and the loan's devastating terms. In court filings, she states she was "unaware that... he faced significant financial demands" and only learned of the loan after his death. She alleges the deal required spousal consent, which she never gave, and accuses CIM of "financial elder abuse."

CIM has filed opposition, calling the claims "fantastical" and noting Karen drew advances from the loan after her husband's death. The group moved to auction the collateralised properties after alleged defaults, but Karen's lawyers secured an emergency stay. She claims to have found a buyer for Casa Encantada—listed for $250 million in 2023 and later relisted at $190 million—but the sale is blocked by CIM's claim.

The saga of Gary Winnick serves as a stark modern parable of how the relentless pursuit of a monumental legacy asset, coupled with complex financial manoeuvres, can lead to spectacular ruin, leaving behind a tangled web of debt and legal acrimony.