Financial markets across the globe were thrown into turmoil on Thursday after Federal Reserve Chair Jerome Powell delivered a sobering message to investors eagerly anticipating a wave of interest rate cuts. Testifying before the Senate Banking Committee, Powell signalled that the central bank is in no rush to slash borrowing costs, insisting policymakers need "greater confidence" that inflation is sustainably cooling towards their 2% target.

The hawkish commentary sent a chill through Wall Street, prompting a broad-based sell-off. The tech-heavy Nasdaq Composite bore the brunt of the selling pressure, cratering as megacap stocks, particularly in the artificial intelligence sector, were hammered.

Nvidia Leads Tech Wreck Amid AI Profit-Taking

Market darling Nvidia, which has been on a historic bull run fuelled by AI exuberance, became a focal point of the day's losses. Its shares nosedived, dragging down the broader chipmaking sector and tech indices. The sharp pullback suggests investors are finally taking profits after a monumental rally, now wary of overheated valuations amidst a higher-for-longer interest rate environment.

Political Crosscurrents: Trump Sweeps Super Tuesday

Adding a layer of political uncertainty to the economic mix were the results from the Super Tuesday Republican primaries. Former President Donald Trump solidified his position as the presumptive nominee after a commanding sweep of victories. Market analysts are now closely weighing the potential implications of a Trump versus Biden rematch on future regulatory and fiscal policy.

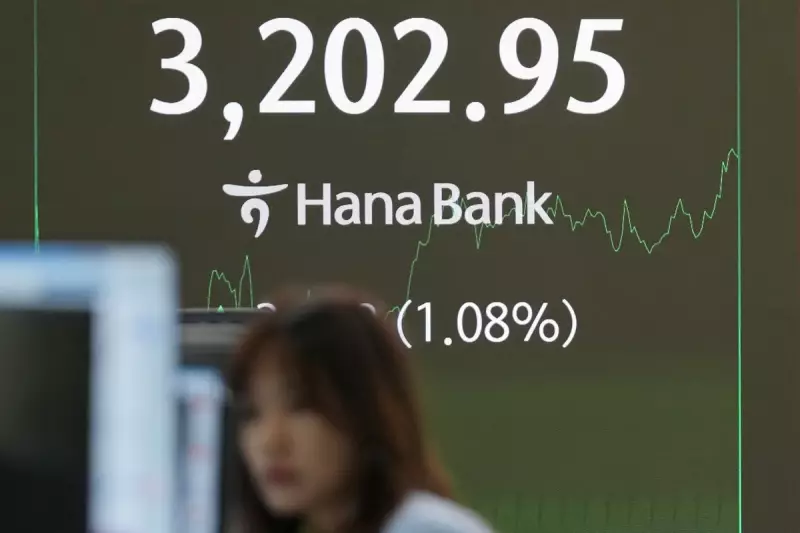

Meanwhile, in Asia, markets took their cue from the negative momentum on Wall Street. Key indices from Tokyo to Hong Kong closed in the red as Powell's testimony dimmed hopes for near-term monetary easing from the Fed, which would have provided support to global risk assets.

Powell's steadfast message underscores a pivotal moment for the US economy. The Fed's cautious approach highlights the delicate balancing act it faces: combatting inflation without triggering a significant economic downturn. For now, investors are being forced to recalibrate their expectations, bracing for continued market volatility.