The global financial markets were thrown into turmoil on Thursday as a spectacular collapse in Nvidia's valuation sparked a chain reaction of selling across international exchanges. The chipmaker's staggering $500 billion plunge – the largest single-session market value drop in history – sent shockwaves from Asian trading floors to Wall Street's opening bell.

Asian Markets Bear the Initial Brunt

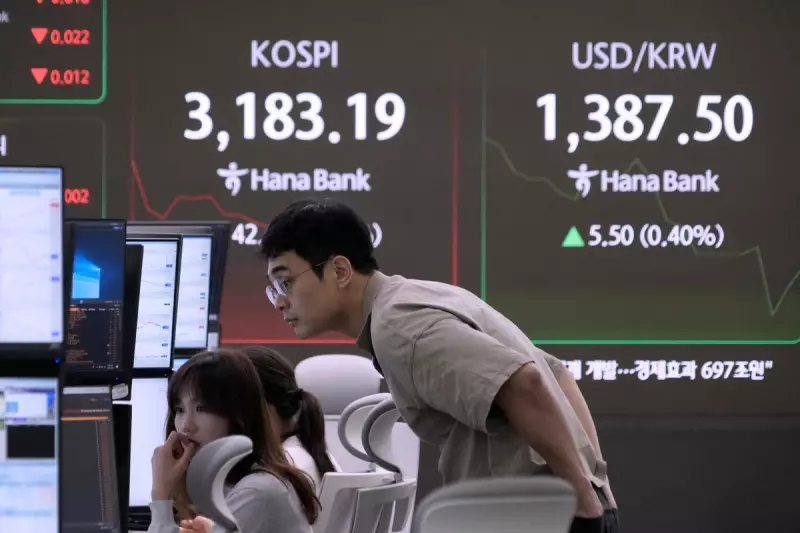

Asian markets absorbed the first impact of Nvidia's disastrous performance, with major indices across the region turning deep red. Japan's Nikkei 225 plummeted by 1.8%, while Hong Kong's Hang Seng index suffered even greater losses, dropping over 2% as investors scrambled to reduce exposure to tech stocks.

The selling pressure wasn't confined to technology sectors. Automobile manufacturers and electronics producers across Asia saw significant declines as traders anticipated reduced demand for advanced chips and components.

Wall Street Braces for Federal Reserve Signals

As attention turned to New York, all eyes were on Federal Reserve Chair Jerome Powell's scheduled testimony before Congress. Market analysts anticipated Powell would maintain his cautious stance on interest rates, potentially exacerbating the negative sentiment gripping trading floors.

"The combination of Nvidia's collapse and Powell's expected hawkish tone creates a perfect storm for equities," noted senior market analyst Eleanor Vance. "We're seeing a fundamental reassessment of tech valuations that could have lasting implications."

Geopolitical Tensions Compound Market Anxiety

Adding to the market's unease were renewed geopolitical concerns following reports of North Korean leader Kim Jong-un overseeing live-fire artillery exercises near the disputed maritime border with South Korea. The provocative military demonstrations introduced additional uncertainty into an already volatile trading environment.

Sector-Wide Impact and Future Outlook

The technology sector's woes appeared to be spreading to broader markets, with futures pointing to substantial losses across European and American indices. Banking stocks, particularly those with significant exposure to technology investments, were expected to face substantial pressure during Thursday's trading session.

Market technicians identified several critical support levels that, if broken, could trigger accelerated selling. The dramatic events underscored the fragile nature of the current market rally and raised questions about the sustainability of tech stock valuations in a higher interest rate environment.