In an extraordinary display of market dominance, Nvidia has catapulted past tech behemoths Amazon and Alphabet to claim the coveted position as the world's fourth most valuable company. The seismic shift occurred during Tuesday's trading session, marking a pivotal moment in the ongoing artificial intelligence revolution.

The Numbers Behind the Surge

Nvidia's shares skyrocketed by an impressive 2.5%, pushing its market capitalisation to a staggering $1.83 trillion. This monumental achievement represents the chipmaker's first-ever closure above the $1.82 trillion threshold, leaving industry analysts and investors alike in awe of its relentless ascent.

The comparison to established tech giants is equally remarkable. Nvidia now stands comfortably ahead of Amazon's $1.76 trillion valuation and has built a significant cushion over Alphabet's $1.81 trillion market cap. Only Microsoft, Apple, and Saudi Aramco now command higher valuations globally.

Fueling the AI Revolution

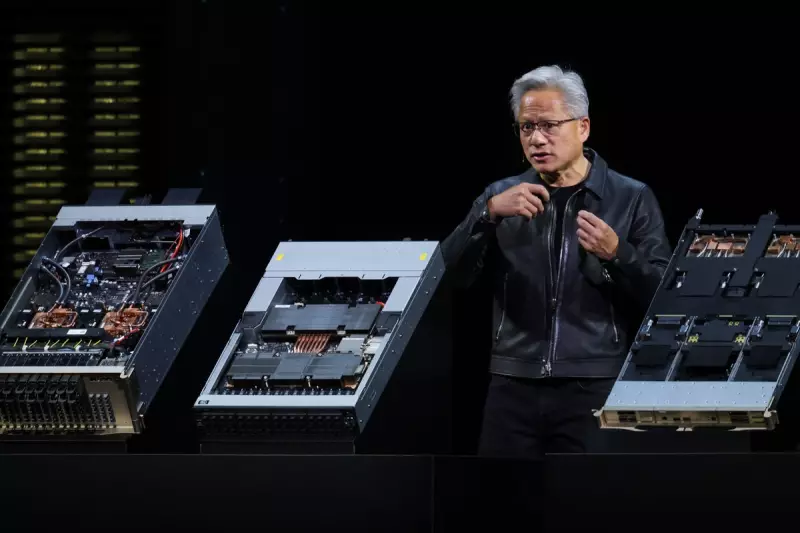

Nvidia's extraordinary performance is intrinsically linked to the explosive growth in artificial intelligence applications. As the primary manufacturer of sophisticated chips powering AI systems across multiple industries, the company has positioned itself at the very heart of technological transformation.

The demand for Nvidia's graphics processing units has reached fever pitch, with tech corporations worldwide scrambling to secure these essential components for their AI infrastructure. This insatiable appetite has translated into unprecedented financial success, with Nvidia recently projecting a jaw-dropping 265% surge in quarterly revenue.

Wall Street's Verdict

Financial markets have responded with overwhelming enthusiasm. Nvidia's stock has surged by an astonishing 47% since the beginning of 2024 alone, building upon its remarkable 239% ascent throughout the previous year. This performance has firmly established Nvidia as the standout success story of the current tech boom.

Analysts from Melius Research captured the market sentiment perfectly, noting that "the only disappointment would be if Nvidia didn't beat and raise again" when the company announces its quarterly results on February 21st.

The Bigger Picture

This market shift represents more than just corporate one-upmanship. It signals a fundamental transformation in how investors perceive value within the technology sector. The traditional dominance of e-commerce and search engines is being challenged by companies specialising in the underlying architecture of artificial intelligence.

As businesses across every sector race to integrate AI into their operations, Nvidia's strategic position as the primary enabler of this technology has proven to be its most valuable asset. The company's success story serves as a powerful indicator of where the global economy is heading in the age of intelligent machines.