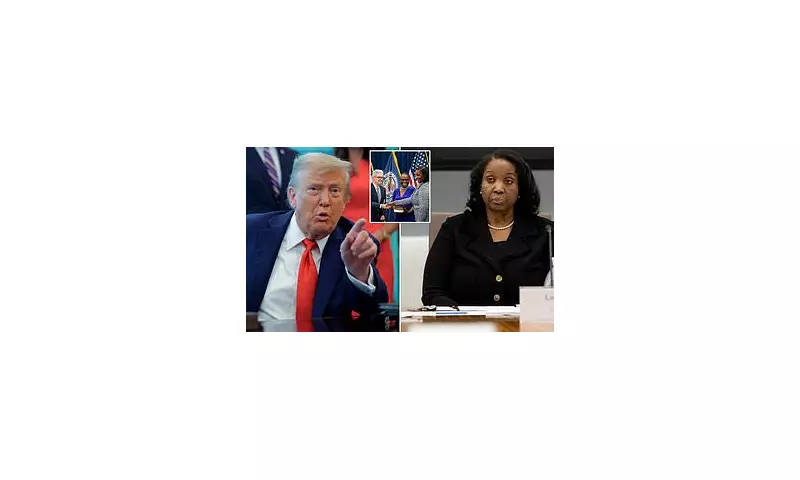

In an extraordinary development that has sent shockwaves through Washington and financial districts alike, Federal Reserve Governor Michelle Bowman has filed a lawsuit against the Trump administration in a bold challenge to presidential authority.

The legal action, lodged in US District Court, centres on President Trump's controversial attempt to demote Governor Bowman from her position as the Fed's top banking regulator. This unprecedented move follows Trump's public criticism of the central bank's interest rate policies.

Constitutional Crisis Brewing

The lawsuit alleges that President Trump overstepped his constitutional authority by seeking to remove Governor Bowman from her key regulatory role while allowing her to remain on the Fed's board. Legal experts describe the case as testing the boundaries of presidential power over independent financial institutions.

"This isn't just about one appointment," said constitutional law professor Eleanor Vance. "This case could redefine the relationship between the executive branch and independent regulatory agencies for generations."

Market Jitters and Economic Implications

The timing of the legal clash has raised concerns among economists and market analysts. With the Federal Reserve currently navigating delicate interest rate decisions amid economic uncertainty, the lawsuit introduces additional volatility to financial markets.

"Investors hate uncertainty," noted Mark Henderson, chief economist at Sterling Capital. "A public battle between the White House and the Fed creates exactly the kind of instability that markets fear most."

Background of the Conflict

Tensions between the Trump administration and the Federal Reserve have been simmering for months. President Trump has repeatedly criticised the central bank's approach to interest rates, arguing that higher rates have hampered economic growth.

Governor Bowman, appointed to the Fed in 2018, has been a key figure in shaping banking regulation and monetary policy. Her lawsuit claims the administration's actions represent an unlawful attempt to influence independent monetary policy decisions.

What Happens Next?

The case is expected to proceed rapidly through the federal court system, with legal observers predicting it may eventually reach the Supreme Court. The outcome could have profound implications for:

- Central bank independence in the United States

- Presidential authority over regulatory appointments

- Market stability during the litigation process

- International confidence in US financial institutions

As both sides dig in for a protracted legal battle, the financial world watches anxiously, aware that the outcome could reshape American economic policy for years to come.