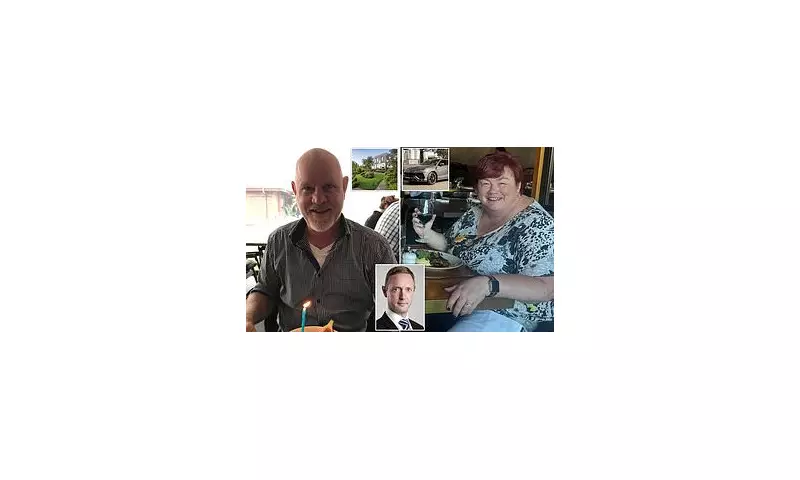

Thousands of Australians are facing a financial nightmare after a major superannuation firm collapsed, leaving millions in retirement savings unaccounted for. The shocking downfall has left policyholders questioning whether they will ever recover their hard-earned money.

What Happened?

The company, once a trusted name in retirement planning, abruptly ceased operations amid mounting financial pressures. Regulators are now scrambling to assess the damage, but early estimates suggest the losses could run into the hundreds of millions.

Who Is Affected?

Policyholders, many of whom had invested decades' worth of savings into their superannuation funds, now face an uncertain future. Experts warn that recovering the lost funds could take years—if it happens at all.

Key Concerns:

- Lost Retirement Savings: Many retirees may see their expected income slashed.

- Regulatory Failures: Questions arise over how the collapse was allowed to happen.

- Legal Battles: Affected individuals may face lengthy court proceedings to reclaim funds.

What’s Next?

Financial advisors urge affected Australians to seek immediate professional advice. Meanwhile, authorities are under pressure to tighten regulations to prevent similar disasters in the future.

The collapse serves as a stark reminder of the risks lurking in even the most trusted financial institutions.