Volkswagen Aims for American Truck Dominance with Scout Revival

Volkswagen, a brand synonymous with fun-loving and trendy vehicles like the Taos SUV and the iconic Golf, faces a significant gap in its American portfolio: it doesn't build a single truck for consumers. For decades, the US market has been dominated by pickup titans like the Ford F-150 and Chevy Silverado. Now, Volkswagen plans to change that with a bold and nostalgic strategy: the revival of the Scout.

The Scout's Return: A Modern Twist on an American Icon

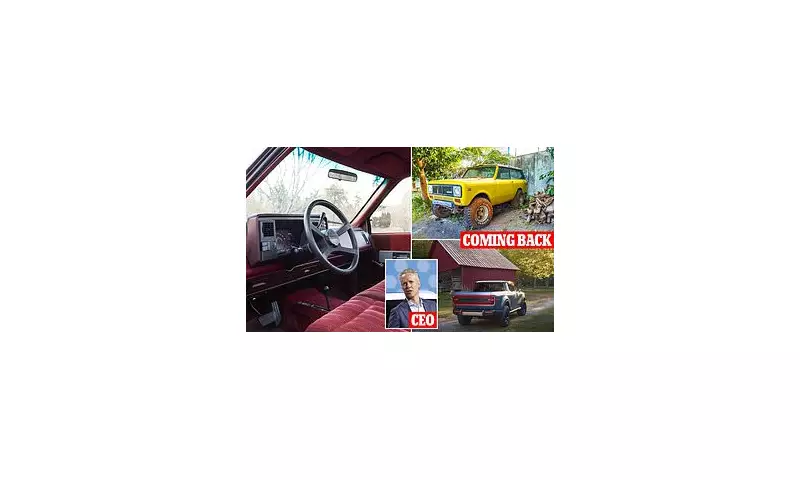

Volkswagen acquired the rights to the Scout brand in 2021, with the first new models—the Traveler SUV and the Terra pickup—scheduled to arrive in late 2027. The original Scout was a rugged, boxy vehicle built by International Harvester, a contemporary of early Ford Broncos and Chevy Blazers, before fading from the market in the 1980s.

This month, Volkswagen revealed the final prototype, and one feature immediately captured attention: a three-seat bench in the front row. This retro touch harks back to a time when such benches were standard in American trucks, offering room for a driver and two adult passengers. Over the last ten years, this classic seating has largely been replaced by captain's chairs and bulky centre consoles.

Scout believes it has solved the space issue that often plagued these benches. By utilising the truck's battery configuration to create a perfectly flat floor, the company has managed to fit an optional front bench and a flat second row, allowing the vehicle to seat six people in total.

Market Demand Shapes Scout's Electric Strategy

The public response has been significant. Scout CEO Scott Keogh reported receiving more than 130,000 non-binding reservations, each requiring a $100 deposit. Crucially, the data from these potential buyers is guiding the brand's powertrain strategy.

Nearly 80% of reservations are not for pure electric vehicles (EVs). Instead, customers are opting for extended-range electric vehicles (EREVs). These trucks run on electricity but use a petrol engine as an onboard generator to recharge the battery during long journeys, effectively eliminating range anxiety.

'The market clearly has spoken, without a doubt, and they like the EREV technology, full stop,' Keogh told Bloomberg. He highlighted that this system provides the truck with enough juice for 500 miles and increases towing capacity, calling it 'EV without the drama.'

This preference reflects a global trend, with strong EREV sales in China and growing interest in Europe. It has also caused a strategic pivot for Scout itself. Originally conceived as a pure electric revival, the brand is now being repositioned with a mostly hybrid lineup. This shift also mirrors a broader EV slowdown, with Ford reconsidering the F-150 Lightning and Dodge cancelling its electric truck plans altogether.

A Multi-Billion Dollar Bet on American Soil

Despite the evolving strategy, Volkswagen's commitment is substantial. The company is constructing a new $2 billion factory in South Carolina to build the Scout SUV and pickup. This facility will also have the capacity to potentially assemble Audi models on the same platform.

Scout is targeting the heart of the US automotive profit pool—the truck and SUV segments that account for roughly 40 percent of industry earnings. The brand is leaning heavily into its American heritage and its new status as an American-made truck built for American buyers, a fact underscored by its prominent placement in the US political sphere, as Vice Presidential candidate Tim Walz famously owns and repairs an original Scout.

With its blend of retro design, flexible electric powertrain, and a dedicated US manufacturing base, Volkswagen's Scout is making a calculated and ambitious bid to finally secure a foothold in America's truck-obsessed market.