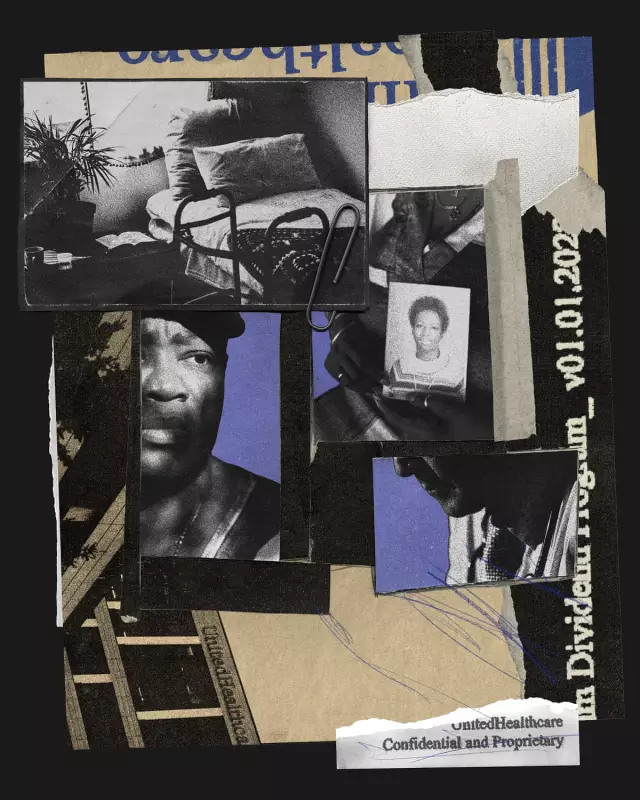

American healthcare giant UnitedHealth Group is facing allegations that its drive to reduce hospital admissions for nursing home residents contributed to the deaths of three elderly individuals, according to pending lawsuits and a state complaint.

Deaths Linked to "Treat in Place" Model

The cases centre on a UnitedHealth initiative where medical staff from its direct care unit, Optum, are placed inside nursing homes to care for residents insured by its insurance arm, UnitedHealthcare. The company states the model provides an "extra layer of caring support" and aims to protect patients by cutting unnecessary hospital admissions—admissions the insurer would otherwise have to pay for.

However, the families of two women and a complaint from a physician's assistant allege this system led to fatal delays in critical hospital care.

In Georgia, the family of 58-year-old Cindy Deal filed a lawsuit claiming she died because Optum and her nursing home failed to hospitalise her for hours after she was found foaming at the mouth and having an apparent seizure. An ambulance was not called until nearly three hours later, and she was pronounced dead shortly after arriving at hospital.

In Ohio, the family of 70-year-old Mary Grant alleges she died after a traumatic head injury from a fall. Despite vomiting and low oxygen levels—potential signs of internal bleeding—an Optum hotline employee did not order a hospital transfer, with company logs noting "the goal is to treat in place." Grant was found dead in her room the next day.

In New York, physician's assistant Christopher Bieniek filed a complaint with state authorities alleging a 63-year-old resident died due to "gross negligence" by an Optum employee who refused to hospitalise the man despite kidney failure.

Whistleblowers Allege Systemic Pressure

UnitedHealth's nursing home programme has also been the subject of at least four whistleblower complaints from former employees. These individuals allege that Optum engaged in unethical tactics to curb costly hospital care and violated rules protecting residents from aggressive insurance sales.

Two former Optum nurse practitioners filed declarations with Congress. They claim managers pressured them to reduce hospital transfers and to encourage residents to adopt "Do-Not-Resuscitate" or "Do-Not-Hospitalise" orders, which could pre-empt expensive emergency care. The declarations also allege supervisors pushed staff to "upcode" patient diagnoses to increase federal Medicare payments to the company.

One whistleblower, Maxwell Ollivant, described seeing large red "STOP" signs in patient charts instructing nursing home staff to call Optum first in an emergency, rather than an independent doctor. He reported concerns after a resident with stroke symptoms experienced a delayed transfer following a call to the Optum hotline.

UnitedHealth has categorically denied all allegations, stating the claims are unsubstantiated or based on incomplete information. The company asserts its model is backed by peer-reviewed studies and high-quality ratings, and that reducing unnecessary hospitalisations protects frail residents from hospital-acquired harms like delirium and falls.

Financial Incentives and Regulatory Scrutiny

The controversy highlights a potential conflict of interest inherent in UnitedHealth's dual role as both insurer and care provider for over 55,000 long-term nursing home residents through Medicare Advantage plans known as Institutional Special Needs Plans (I-SNPs).

Under Medicare Advantage, the government pays insurers a set amount per patient. The less an insurer spends on care, the more it retains as profit. Lawmakers and whistleblowers frame this as an incentive to discourage necessary, costly hospitalisations.

Policy experts acknowledge reducing unnecessary hospitalisations is important but caution against overcorrection. "You don't want to... align the incentives so that people are never sent to the hospital when they really need to go," said Gretchen Jacobson of the Commonwealth Fund.

Following a previous Guardian report on UnitedHealth's nursing home initiative, Senators Ron Wyden and Elizabeth Warren launched an investigation. "Nursing home residents and their families should not live in fear of a for-profit health care company withholding care when it is most critical," they wrote.

UnitedHealth, which reported over $400 billion in revenue last year, sued the Guardian for defamation in June over its earlier reporting. The company maintains its legal action is an extraordinary step to protect the integrity of its work and care teams.