A British woman has found herself at the centre of an extraordinary insurance dispute after her claim for magpie-related garden damage was rejected because of her pre-existing fear of birds.

The Garden Invasion

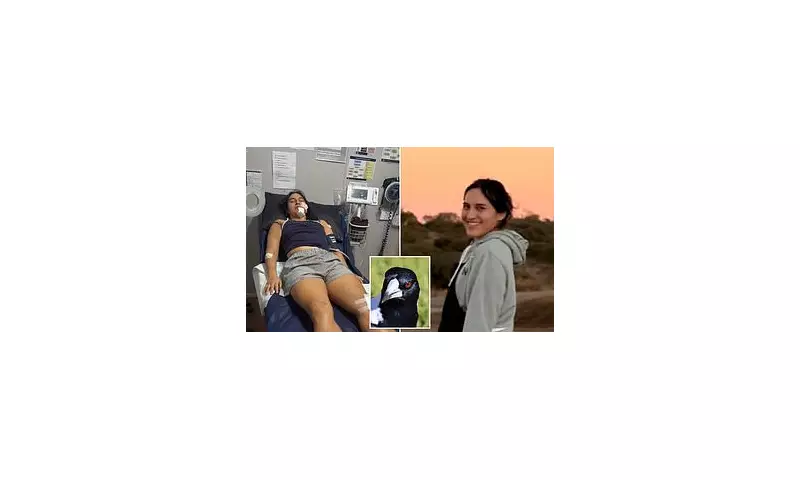

The policyholder, who wishes to remain anonymous, sought coverage under her insurance policy after a group of magpies systematically destroyed her garden, causing significant damage to plants, furniture, and outdoor decorations. The aggressive birds had taken up residence in her garden, creating what she described as "absolute havoc" over several weeks.

The Shocking Rejection

In a decision that has raised eyebrows across the insurance industry, the woman's claim was denied outright. The insurance company pointed to a previously disclosed bird phobia in her medical history, arguing this constituted a "pre-existing condition" that invalidated her claim for bird-related damage.

The rejection letter stated: "Your documented ornithophobia (fear of birds) represents a known vulnerability to incidents of this nature, which falls under our policy exclusions for pre-existing conditions that increase risk exposure."

Industry Experts Weigh In

Insurance specialists have expressed astonishment at the reasoning behind the claim denial. Several industry professionals confirmed that while pre-existing conditions are typically considered in health and life insurance contexts, applying this principle to property damage claims represents an unusual interpretation of policy terms.

One insurance expert commented: "This case appears to stretch the definition of 'pre-existing condition' beyond its conventional meaning in property insurance. Fear of birds, while genuine and distressing for the individual, doesn't typically factor into assessments of garden damage claims."

What This Means for Policyholders

The controversial case highlights several important considerations for insurance customers:

- Carefully review policy exclusions and definitions

- Understand how insurers might interpret "pre-existing conditions"

- Seek clarification on unusual policy terms before purchasing coverage

- Consider independent advice when dealing with complex insurance matters

The Road Ahead

The policyholder is currently exploring her options, including filing a formal complaint with the Financial Ombudsman Service. The case has drawn attention from consumer rights advocates who argue that such interpretations of insurance policies could set concerning precedents for future claims.

As magpie populations continue to thrive in urban areas across the UK, this case raises questions about how insurers will handle similar claims in the future and what constitutes reasonable grounds for claim rejection.