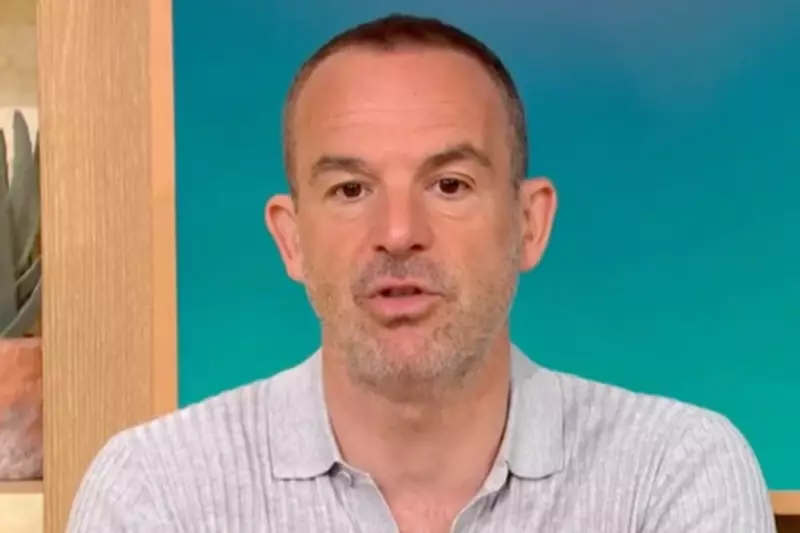

Consumer rights advocate Martin Lewis has issued a stark warning to millions of UK drivers who may have been mis-sold car finance deals, potentially entitling them to significant compensation payouts.

The Hidden Commission Scandal

At the heart of the issue lies the widespread practice of undisclosed commission arrangements between lenders and car dealerships. Many consumers were unaware that dealers received substantial kickbacks for arranging finance agreements, particularly on Personal Contract Purchase (PCP) deals.

Who Could Be Affected?

The scandal potentially affects anyone who:

- Purchased a car on finance between 2014 and 2019

- Entered into a PCP or Hire Purchase agreement

- Wasn't properly informed about commission arrangements

Martin Lewis's Urgent Advice

The MoneySavingExpert founder is urging affected consumers to submit complaints to finance providers immediately. "This could be the next major financial mis-selling scandal," Lewis warned, drawing parallels with the PPI compensation scheme.

How to Claim

Consumers should:

- Gather all relevant finance documentation

- Submit a formal complaint to their lender

- Escalate to the Financial Ombudsman Service if unsatisfied

Potential Compensation Figures

While individual payouts will vary, some analysts suggest successful claims could average between £1,000 and £5,000 per customer. The total industry liability could run into billions of pounds.

The Financial Conduct Authority has launched an investigation into the sector, with findings expected to shape the compensation landscape in coming months.