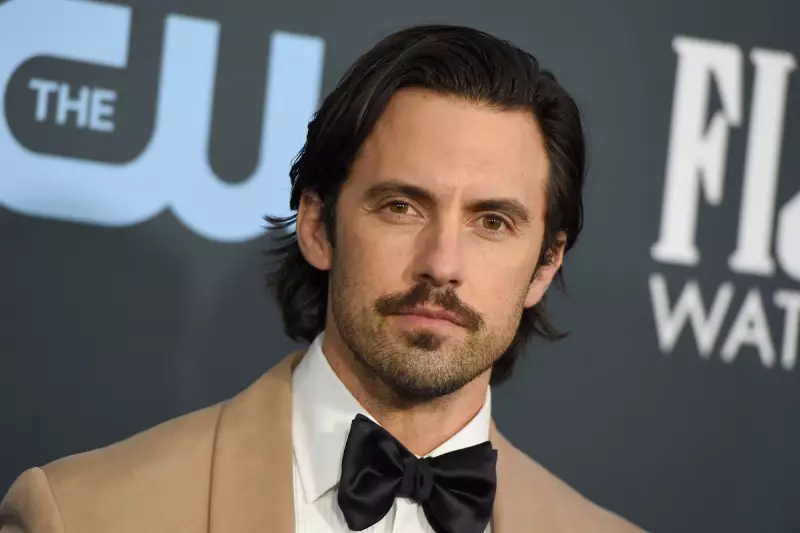

Financial experts across the UK are championing a simple piece of money advice shared by actor Milo Ventimiglia, best known for his roles in This Is Us and Gilmore Girls. The star revealed that his mother's guidance to wait until you "can't stand it any longer" before making a non-essential purchase has shaped his financial decisions.

The Power of the Pause: Why Waiting Works

This 'wait-now, buy-later' philosophy has found a strong advocate in Erika Rasure, chief financial wellness advisor at Beyond Finance. Rasure endorsed the approach as a powerful tool for emotional regulation rather than deprivation. She explained that allowing an emotional urge to pass provides clarity, helping to distinguish a genuine desire from a fleeting impulse.

Luther Yeates, head of mortgages at UK Expat Mortgage, also praised the tactic. He noted that it naturally reduces impulsive decision-making, a common financial pitfall. Yeates drew a direct parallel to mortgage lending, where banks scrutinise spending behaviour. "We advise customers to avoid major purchases like cars or holidays 3-6 months before a mortgage application," he stated, highlighting that lenders view impulsive spending as a risk indicator.

Putting the Advice into Practice: Expert Modifications

While Ventimiglia's mantra doesn't specify a timeframe, personal finance experts suggest practical adaptations. Jim Wang, founder of Wallet Hacks, recommends a cooling-off period of 24 to 48 hours for desired items. "You'll often find the desire to purchase it goes away and you forget about it," Wang observed. If the want persists, it may be a sign of a meaningful purchase.

Dean Lyulkin, CEO of business financing firm Cardiff, teaches a more structured version to his children. For big-ticket 'wants', he advocates a three-step process: pause, write the item down, and set a future review date—but only after linking the potential purchase to a specific goal. "This trains your brain to associate spending with intention and progress, not emotional relief," Lyulkin said. He pointed out that Ventimiglia's method of waiting until you can't bear it risks surrendering to emotion, whereas a deliberate, goal-tied approach builds a more valuable financial skill.

Building Better Financial Habits Over Time

The consensus among professionals is clear: enforcing a waiting period is a foundational habit for long-term financial health. It transforms desire into a deliberate, goal-driven decision, a skill applicable to both teenagers and adults. The practice helps consumers avoid emotional spending, leading to more thoughtful purchases and stronger money management over time. As these experts confirm, sometimes the best financial strategy isn't a complex investment plan, but a simple, motherly piece of wisdom to just wait.