In a welcome move for households across Great Britain, the energy regulator Ofgem has announced a substantial reduction in its price cap, set to take effect from 1st July. The cap will fall by 7%, or £122, bringing the typical annual dual-fuel bill down to £1,568.

This reduction marks the lowest level for the energy price cap since the onset of the global energy crisis, which was triggered by Russia's invasion of Ukraine in early 2022. The move is expected to provide significant financial relief to millions of families grappling with the high cost of living.

What the New Cap Means for Your Wallet

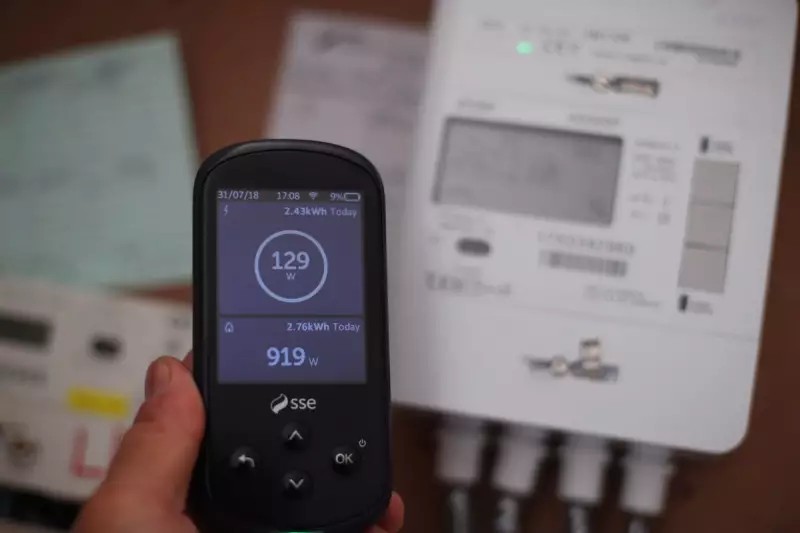

The new cap dictates the maximum amount that energy suppliers can charge per unit of energy. For the average household consuming a typical amount of gas and electricity and paying by direct debit, this translates to an annual bill of £1,568. It is crucial to note that this is not an absolute cap on your total bill; if you use more energy, you will pay more.

The July reduction follows a previous drop in April, indicating a cautiously optimistic trend for consumers after two years of record-high bills.

A Cautious Outlook and Calls for Further Support

While the news is positive, experts and campaigners are quick to warn that bills remain hundreds of pounds higher than pre-crisis levels. Jonathan Brearley, the chief executive of Ofgem, acknowledged this, stating that the market remains volatile and prices are still "historically high."

Campaign groups like Energy UK and Citizens Advice have used the announcement to reiterate calls for the next government to develop a long-term strategy for tackling energy costs. Suggestions include social tariffs for vulnerable households and a major, government-backed home insulation scheme to improve energy efficiency and reduce bills permanently.

The future of the price cap itself is also a topic of debate, with Ofgem consulting on potential changes to make it "fit for the future" and more reflective of current market risks.