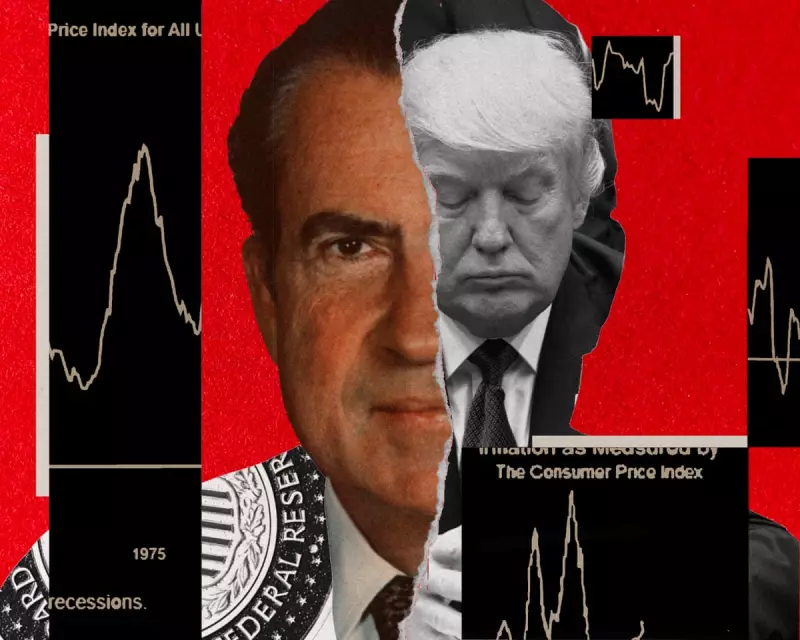

In a move that has sent tremors through financial markets and drawn stark historical comparisons, former President Donald Trump has launched what experts are calling a "Nixon-style" assault on the Federal Reserve's independence.

A Chilling Historical Parallel

The current situation bears unsettling resemblance to President Richard Nixon's heavy-handed approach to monetary policy in the early 1970s. Nixon infamously pressured Fed chair Arthur Burns to keep interest rates artificially low ahead of his 1972 re-election campaign, a decision many economists blame for triggering years of devastating inflation.

"We're seeing history repeat itself in the most dangerous way possible," warned Dr. Eleanor Vance, economic historian at the London School of Economics. "Political interference in central banking undermines the very foundation of economic stability."

The Modern Fed Under Fire

Trump's recent campaign has involved public demands for immediate interest rate cuts and direct criticism of current Fed leadership. His rhetoric suggests he would seek to replace Fed chair Jay Powell if re-elected, raising fundamental questions about the institution's cherished independence.

The consequences could be severe:

- Immediate market volatility and investor uncertainty

- Long-term damage to the Fed's inflation-fighting credibility

- Potential resurgence of 1970s-style stagflation

- Erosion of international confidence in US economic leadership

Global Ripples and British Concerns

The implications extend far beyond American borders. As the world's reserve currency, decisions affecting the US dollar have immediate consequences for global trade and emerging markets.

Bank of England officials are reportedly monitoring the situation closely, concerned that political instability at the Fed could complicate their own monetary policy decisions and threaten financial stability worldwide.

"When the world's most powerful central bank faces political pressure, every economy feels the effects," noted financial analyst Michael Chen. "This isn't just an American problem—it's a global economic threat."

What History Teaches Us

The Nixon-era experiment with political control of monetary policy ended disastrously, with inflation spiralling to double digits and requiring years of painful economic medicine to correct. Many economists fear a repeat scenario could be even more damaging in today's interconnected global economy.

As the 2024 election approaches, the independence of the Federal Reserve has suddenly become one of the most critical economic issues facing voters and markets alike.