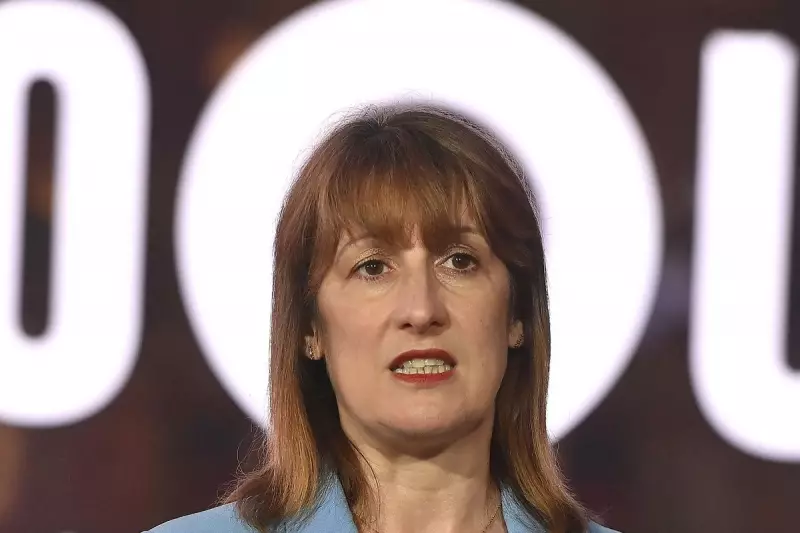

Shadow Chancellor Rachel Reeves has firmly dismissed any speculation that a Labour government would raise inheritance tax, countering claims circulating among Conservative circles.

In a statement ahead of the upcoming Autumn Budget, Reeves emphasised that Labour has no plans to increase the levy, which currently stands at 40% on estates valued over £325,000.

Political Tensions Over Tax Policy

The debate over inheritance tax has intensified in recent weeks, with some Tory MPs suggesting Labour might target wealthier estates to fund public spending. However, Reeves labelled these claims as "misleading scaremongering" and reiterated Labour's commitment to fiscal responsibility.

What This Means for Households

With rising property prices pushing more estates into the inheritance tax threshold, many families have expressed concerns over potential hikes. Reeves' announcement provides clarity for those worried about future tax burdens.

- Current threshold: £325,000 (£500,000 if passing home to children)

- Tax rate: 40% above threshold

- Labour commits to no increases

Broader Economic Strategy

The Shadow Chancellor's comments align with Labour's wider economic messaging, focusing on growth rather than increased taxation. Experts suggest this approach aims to reassure middle-class voters while differentiating Labour from Conservative tax policies.

As the Autumn Budget approaches, all eyes remain on how both parties will address Britain's fiscal challenges without alienating key voter demographics.