The UK economy faces significant headwinds from planned tax increases and public spending cuts, which will slow growth and keep inflation stubbornly high among leading nations, according to a major new international report.

Fiscal Consolidation to Curb Growth

In its latest economic outlook, the Organisation for Economic Co-operation and Development (OECD) stated that the government's policy of fiscal consolidation will act as a brake on the UK's economic expansion. The Paris-based organisation warned that past and planned adjustments to taxes and expenditure are squeezing household disposable incomes and slowing down consumer spending.

The influential body predicts UK growth will decelerate from 1.4% in 2025 to 1.2% in 2026, before making a very modest recovery to 1.3% in 2027. It highlighted "substantial" downside risks to these forecasts, tied directly to the scale of fiscal tightening. While the forecast for 2025 was left unchanged, the prediction for 2026 was upgraded from the 1% estimate made just three months ago.

Inflation and Interest Rate Outlook

The report presents a further challenge for policymakers, noting that UK inflation is set to be the highest in the G7 this year at 3.5%. While easing, it is projected to remain the second highest in the group in 2026 at 2.5%, trailing only the United States. Inflation is not expected to fall close to the Bank of England's 2% target until 2027, when it will hit 2.1%.

On interest rates, the OECD anticipates two more cuts from the current 4% to 3.5% by mid-2026, after which it believes the rate-cutting cycle will end. It cautioned that rates could stay higher for longer if inflation proves persistent, exacerbated by high food costs and the impact of April's increase in payroll tax, which is pushing firms to raise prices.

Budget Fallout and Political Reaction

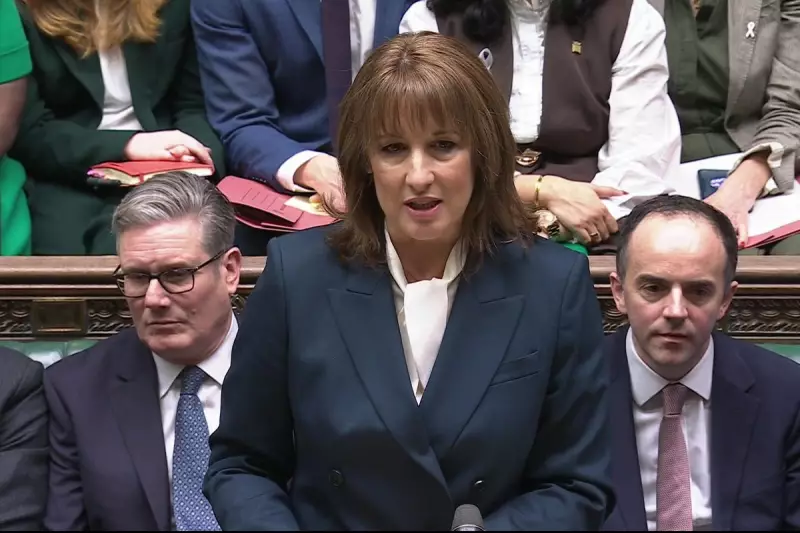

The OECD's assessment lands amid intense political scrutiny of Chancellor Rachel Reeves's recent Budget, delivered on November 26. The budget included around £26 billion in tax rises, such as a freeze on income tax thresholds predicted to draw 1.7 million more people into higher tax brackets. The Office for Budget Responsibility (OBR) subsequently downgraded its growth forecasts for the next four years.

Responding to the report, Chancellor Reeves focused on the positive revisions, stating: "Less than a week later, the OECD has upgraded our growth and cut its forecast for inflation next year." She argued her Budget choices are expected to cut inflation by 0.4 percentage points.

In contrast, Shadow Chancellor Sir Mel Stride criticised the government's approach: "Rachel Reeves promised growth but growth is expected to weaken next year, because of her choices. This is the cost of policies that punish work, businesses and investment."

Globally, the OECD kept its forecasts steady, predicting world GDP growth will slow from 3.2% in 2025 to 2.9% in 2026, before recovering to 3.1% in 2027. It warned that the full effects of higher global tariffs are yet to be felt but are already influencing business costs and consumer prices.