Major UK banks are preparing to close hundreds of branches this summer, leaving many customers without easy access to in-person banking services. The move comes as more people shift to online and mobile banking, reducing foot traffic in physical locations.

Which Banks Are Closing Branches?

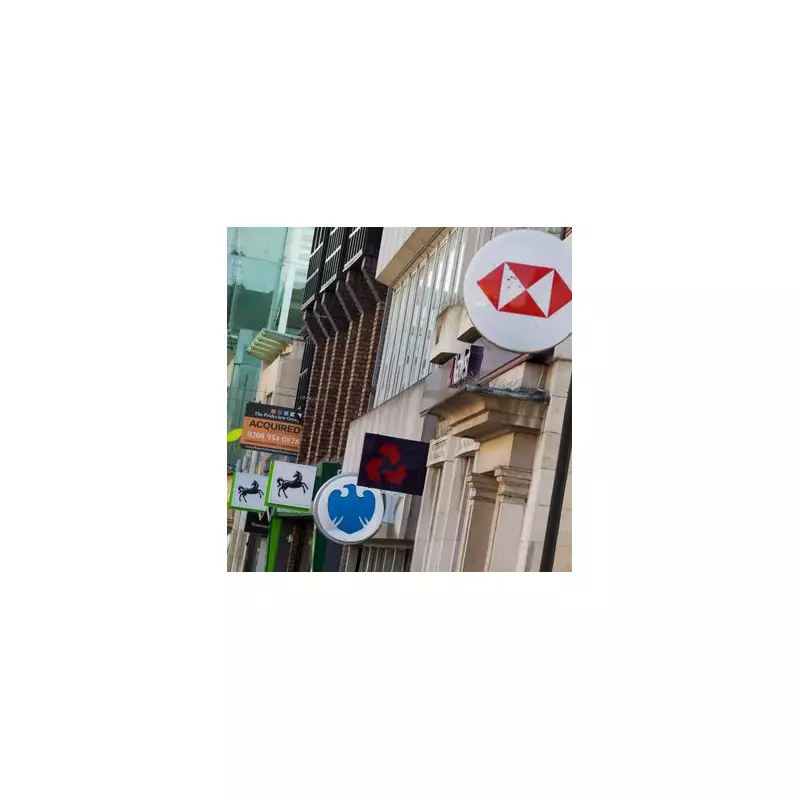

Several high-street names, including Barclays, Lloyds, and NatWest, have announced plans to shut down branches across the country. The closures are part of a wider trend in the banking sector, with over 5,000 branches having closed since 2015.

Full List of Affected Locations

The closures will impact towns and cities nationwide, with rural areas particularly hard hit. Some of the affected locations include:

- Barclays – 15 branches closing

- Lloyds – 12 branches shutting down

- NatWest – 10 locations affected

- HSBC – 8 branches closing

What Does This Mean for Customers?

With fewer physical branches available, customers may need to travel further for face-to-face services or rely more heavily on digital banking options. Many banks are introducing 'banking hubs' where multiple providers share space, but these remain limited in number.

Consumer groups have expressed concern about the impact on elderly customers and those without reliable internet access. The UK's ageing population continues to rely on branch services for complex transactions and financial advice.

The Future of High-Street Banking

Industry experts predict the branch closure trend will continue as digital adoption grows. However, calls are growing for banks to maintain at least some physical presence, particularly in areas with poor digital infrastructure or vulnerable populations.

The upcoming summer closures mark another significant shift in how Britons access banking services, with the traditional high-street branch becoming an increasingly rare sight.