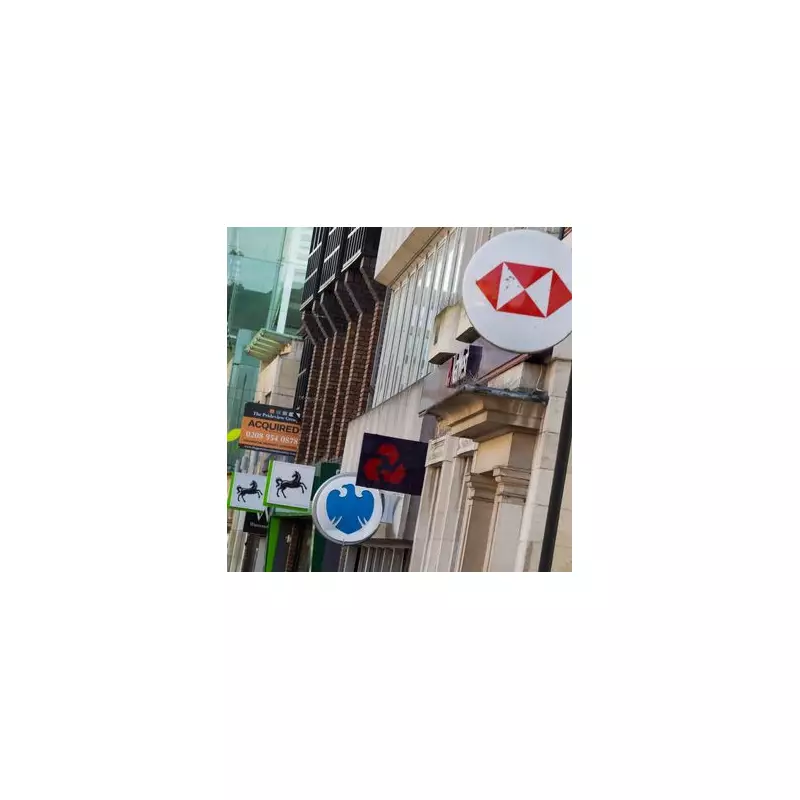

In a significant blow to the British high street, two of the UK's largest banking groups have confirmed a sweeping closure programme, set to permanently shutter 39 branches across England and Wales throughout 2025.

The move, announced by NatWest and Halifax, reflects the accelerating pace of change in how Britons manage their money, with a relentless shift towards digital and mobile banking rendering many physical locations unsustainable.

The Numbers Behind the Decision

NatWest Group is set to close 21 branches under its various brands, including:

- 11 Royal Bank of Scotland branches

- 7 NatWest branches

- 3 Ulster Bank branches (in Wales)

Meanwhile, Halifax, which is part of the Lloyds Banking Group, will close 18 of its sites. The banking conglomerate stated that these decisions are never taken lightly and follow a thorough review of each branch's usage.

Why Are Banks Closing Branches?

The primary driver behind this exodus is a seismic change in customer behaviour. The banks report a dramatic and irreversible decline in footfall, with the majority of customers now opting for the convenience of online and app-based banking for their day-to-day transactions.

With over 90% of current account holders using digital channels, the cost of maintaining underused physical premises has become increasingly difficult to justify from a business perspective.

What Does This Mean for Customers?

For customers affected by the closures, the banks have emphasised alternative ways to bank:

- Post Office Services: Everyday banking transactions can be completed at any of the UK's 11,500 Post Office branches.

- Community Bankers: In some areas, 'mobile' bank managers will be deployed to offer face-to-face support in community centres.

- Digital Support: Enhanced online tutorials and telephone support will be available, particularly for vulnerable customers or those less confident with technology.

Despite these alternatives, campaigners warn that the closures will disproportionately affect the elderly, vulnerable, and small businesses who still rely on in-person banking services, potentially leaving some communities without easy access to cash or financial advice.

The full list of doomed branches serves as a stark reminder of the rapidly evolving financial landscape, signalling the end of an era for the traditional British high street bank.