Nationwide Building Society has moved to clarify its payment rules following a public complaint from a customer left frustrated by a delayed refund. The incident highlights the often-misunderstood process of 'pending' transactions and the timeframes involved.

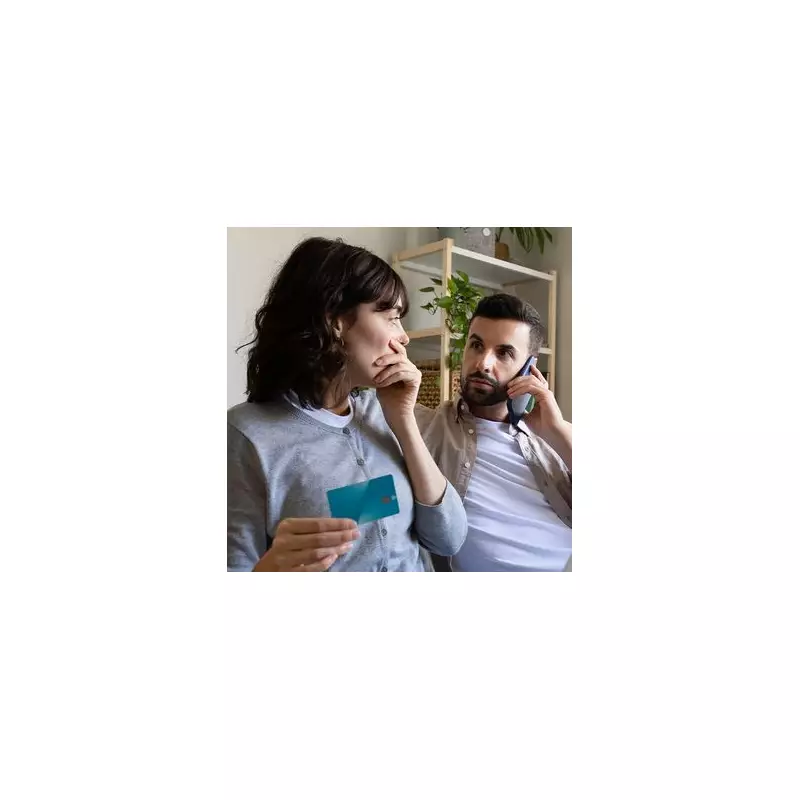

Customer Frustration Over 'Lost' Funds

The issue came to light when a disgruntled customer took to social media on January 12 to vent about a problematic payment. The customer explained that a payment to mobile network EE was taken from their account on January 4. After cancelling the order the very next day, they were left waiting over a week for the money to be returned.

"Still pending on my account. Why should the consumer lose the said amount for over a week for no goods?" the customer fumed, describing their efforts to resolve the matter as a "waste of time".

Nationwide's Clarification on Payment Timeframes

In response, Nationwide provided detailed guidance on its standard procedures. A spokesperson for the building society explained that a card payment will typically show as pending for seven days. This period allows for the receipt of a clearing file from the merchant to match off the transaction.

"This is a standard industry timeframe," the spokesperson stated. Regarding refunds, they added: "The refund will be returned to the account as soon as it is received from the merchant. Merchants' typical time frame quoted is five to seven days."

What Happens After Seven Days?

Nationwide's own online guidance offers further clarity. It confirms that if a pending transaction hasn't been taken by the company after the seven-day period, the society will stop reserving the money, making it available to spend again. The pending transaction will disappear from the account view and the available balance will be corrected.

However, the building society also issued an important warning for current account holders. Some pending transactions can take a surprisingly long time to finalise. "For current accounts, it's a good idea to keep enough money in your account to cover the payment. That's because some can take up to 180 days to go through," the guidance states, noting the money could still be claimed by the merchant much later.

How to Dispute a Payment

For customers who find themselves in a similar situation, Nationwide outlined the available routes to challenge a payment. A customer can dispute a payment in multiple ways, including via a branch, the contact centre, or through online services.

Following the complaint, Nationwide confirmed it had sent a direct message to the individual customer involved to address their specific case in more detail.