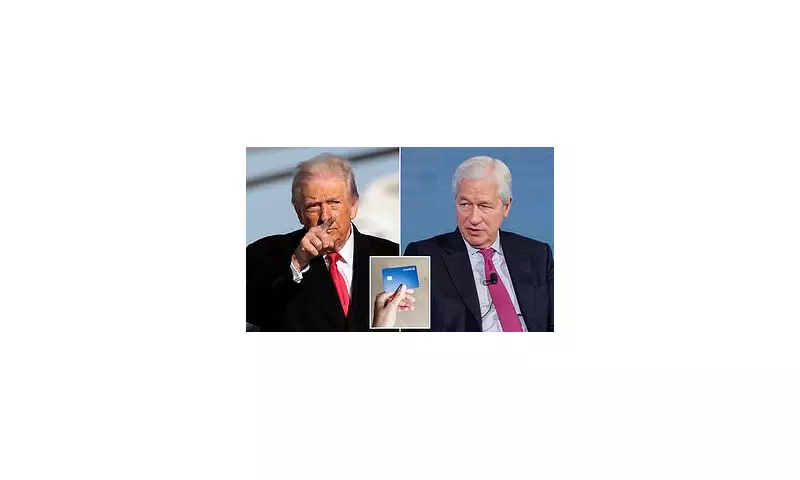

JPMorgan CEO Jamie Dimon Delivers Blunt Warning Over Trump's Credit Card Interest Cap Proposal

JPMorgan Chase's chief executive, Jamie Dimon, has delivered a scathing assessment of President Donald Trump's controversial plan to impose a temporary cap on credit card interest rates. Speaking at the World Economic Forum in Davos, Dimon did not mince words when asked about the proposal, which Trump announced earlier this month via his Truth Social platform.

'It would be an economic disaster — and I'm not making that up,' declared Dimon emphatically. He added, 'Our business would survive it, by the way.' The veteran banker warned that the real victims would not be the financial institutions themselves, but rather a broad swathe of the American economy.

Dimon Predicts Widespread Credit Crunch and Economic Fallout

Dimon elaborated that a hard cap on interest rates could result in as many as 80 percent of Americans losing access to credit entirely. He argued that the most severe impact would be felt beyond the banking sector. 'The people crying the most won't be the credit card companies, it will be the restaurants, the retailers, the travel companies, the schools, the municipalities because people will miss their water payments,' he stated.

The CEO's comments come amid heightened political tensions. Shortly after his Davos appearance, it emerged that Trump had filed a substantial $5 billion lawsuit against JPMorgan Chase, accusing the bank and its CEO of 'de-banking' him for political motives.

Banking Industry Unites in Opposition to Proposed Cap

Dimon's stance is firmly supported by the wider banking industry. JPMorgan's Chief Financial Officer, Jeremy Barnum, echoed the sentiment during a post-earnings call with analysts. He cautioned that lenders would likely respond by reducing the supply of credit rather than making it cheaper for consumers. 'Instead of lowering the price of credit, we'll simply reduce the supply of credit — and that will be bad for everyone,' Barnum explained.

Other major financial institutions have joined the chorus of opposition. Wells Fargo's CFO, Mike Santomassimo, warned of a 'significant negative impact on credit availability for a wide spectrum of people' and cautioned that such a cap would adversely affect US economic growth. Similarly, Citigroup's CFO, Mark Mason, stated that a rate limit would restrict credit 'to those who need it most' and could potentially trigger a broader economic slowdown, with unintended consequences for consumers.

Political Divisions and a Provocative Suggestion

Dimon also took aim at left-leaning lawmakers who support the interest cap, notably Democratic Senators Bernie Sanders of Vermont and Elizabeth Warren of Massachusetts. In a provocative challenge, Dimon suggested: 'I think we should test it. The government can do it, they should force all the banks to do it in two states - Vermont and Massachusetts - and see what happens.'

President Trump's proposal forms part of a broader affordability drive, with the former president accusing lenders of 'ripping off' Americans with interest rates that typically range from 20 to 30 percent. Current data from Bankrate.com shows the average credit card interest rate stands at 19.7 percent—nearly double the 10 percent level Trump is targeting.

Fundamental Shift in Credit Card Economics

The banking sector argues that capping rates would fundamentally alter how credit cards operate. They contend that the high rates reflect the risk of lending to consumers with varying creditworthiness. A sharp, government-mandated reduction in access to credit could, as the CFOs warned, significantly dampen consumer spending—a major engine of the US economy—thereby creating a ripple effect of negative consequences far beyond the financial services industry.