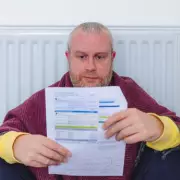

Average UK mortgage rate drops below 6.2%

Average mortgage rates have hit a 14-month low, falling below 6.2% for the first time since October 2024. Experts say this offers a 'welcome gift' for homebuyers. Read more on what this means for the UK housing market.