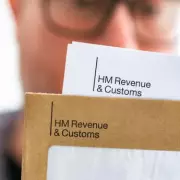

Reeves Plans Landlord Tax Raid: NI on Rental Income

Exclusive: Chancellor Rachel Reeves is considering applying National Insurance to rental income in a major tax overhaul targeting landlords, as Labour seeks to fill a £50bn spending gap. The controversial move could reshape the UK's buy-to-let market.