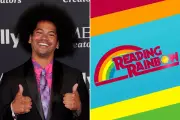

Reading Rainbow Returns with Mychal Threets as Host

The iconic children's educational programme Reading Rainbow is set for a spectacular comeback, with former librarian Mychal Threets bringing his viral book enthusiasm to a new generation of young British readers.