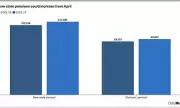

Inheritance tax receipts hit record £6.3bn

HMRC reports unprecedented inheritance tax receipts as frozen thresholds and soaring property prices drag more families into the tax net. Discover how fiscal drag is transforming IHT from a 'wealth tax' to a middle-class concern.