Millions of British pensioners are facing a devastating financial blow despite the promised state pension increase coming in April, as HMRC's frozen tax thresholds threaten to swallow the entire raise and more.

The Great Pension Tax Grab

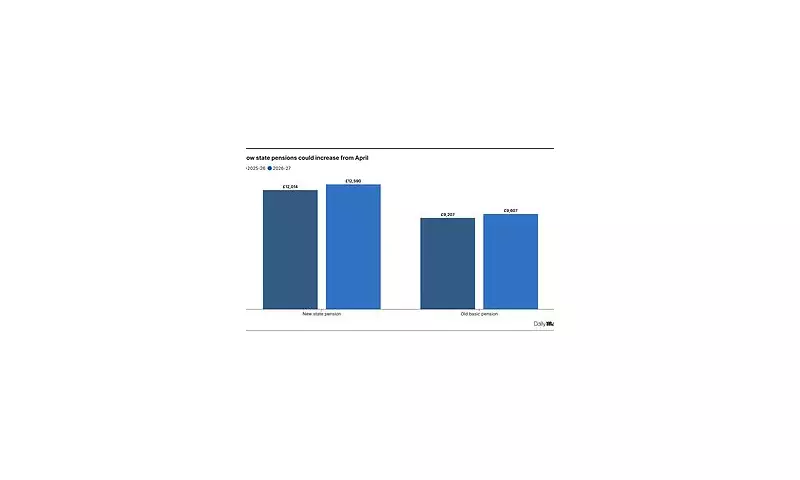

While the government proudly announces an 8.5% state pension increase that would push the full new state pension above £11,500 annually, a stealth tax move means many retirees won't see a penny of this boost. The personal allowance freeze at £12,570 until 2028 is creating a perfect storm for pensioners whose incomes are gradually creeping into taxable territory.

How the Numbers Stack Up Against You

The mathematics reveals a harsh reality: a single pensioner with a full new state pension as their only income will remain below the tax threshold. However, those with additional income streams – whether from workplace pensions, private pensions, or part-time work – face an increasingly heavy tax burden.

The Stealth Tax Time Bomb

This isn't just about this year's increase – it's about four more years of threshold freezes while pensions continue to rise under the triple lock. Each percentage point increase pushes more pensioners into the tax net or increases the tax bill for those already paying.

Who's Really Affected?

- Pensioners with combined income streams exceeding £12,570

- Those with workplace pensions alongside state pensions

- Retirees who continue to work part-time

- Couples where both partners have substantial pension income

The Political Fallout

Campaign groups and opposition parties are calling this a "betrayal of Britain's pensioners" and demanding immediate action to protect retirement incomes. The controversy highlights the growing tension between headline-grabbing pension increases and the less visible tax policies that undermine them.

With inflation pressures continuing and living costs remaining high, this tax threshold freeze could mean the difference between comfort and struggle for millions of Britain's retirees.