Chancellor Rachel Reeves is preparing a series of tax increases targeting everyday items and holidays as part of the upcoming Budget, scheduled for November 26.

Sweet Drinks and City Breaks in the Firing Line

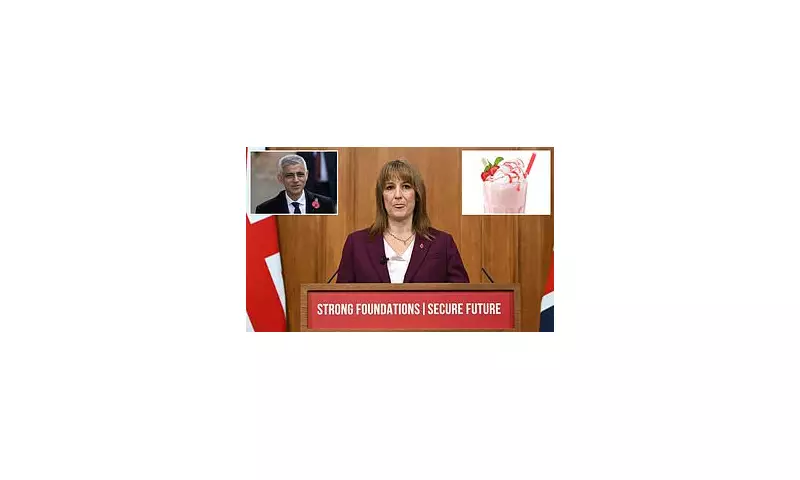

In a significant move, the government is expected to toughen the existing Soft Drinks Industry Levy, commonly known as the 'Sugar Tax'. The change would remove the current exemption for milk-based drinks, potentially affecting around 200 products.

Draft proposals suggest that sugary milkshakes could face charges of 26p per litre. Furthermore, the threshold for paying the tax would be lowered from 5g of sugar per 100ml to 4g, drawing many more beverages into the tax net.

Simultaneously, the Chancellor is poised to give the green light for 'tourist taxes' to be imposed by mayors across England. This policy would allow local authorities to add a charge to overnight stays in hotels and bed and breakfasts.

The Financial and Political Backdrop

These measures are part of a desperate scramble to raise funds after the government humiliatingly dropped its plan to increase income tax, a move that would have breached Labour's election manifesto promises.

Ms Reeves is now looking at a 'Smorgasbord' of smaller tax hikes to help fill a financial black hole that could be as large as £40 billion.

The tourist tax initiative is projected to raise more than £500 million a year. It is understood that London's Labour Mayor, Sadiq Khan, is a supporter and could potentially raise £200 million for the capital alone.

Broader Tax Impacts on Households

Beyond these new levies, the Chancellor is set to extend the freeze on income tax thresholds for another two years. This policy is expected to net the Treasury more than £8 billion a year but will come at a significant cost to Britons.

By the end of the decade, more than 10 million people could be pushed into paying the top rate of tax. Some couples will see their tax bill rise by £1,300 compared to if the freeze ended as originally planned.

The policy will also hit lower earners, with a full-time worker on the minimum wage facing an annual tax increase of £137. In a historic first, all pensioners will be taxed on the full state pension from 2027-28.