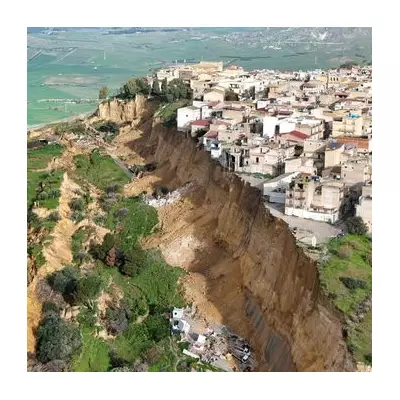

The British government is actively preparing contingency plans for the potential emergency temporary nationalisation of Thames Water, as the country's largest water supplier teeters on the brink of financial collapse under a staggering £15 billion debt burden.

Senior Whitehall sources have confirmed to The Independent that Treasury officials and industry regulator Ofwat are developing a secret blueprint codenamed "Project Timber" should the utility giant fail to secure crucial new investment.

Systemic Risk to UK's Water Infrastructure

With approximately 15 million customers across London and the Thames Valley region, the company's potential failure represents the most significant threat to Britain's water infrastructure in decades. The crisis has prompted urgent discussions at the highest levels of government about safeguarding this essential public service.

Thames Water's enormous debt pile, coupled with soaring interest payments and mounting regulatory pressures, has created a perfect storm that threatens its operational viability. The company's financial struggles come amid growing public anger over sewage discharges and service quality issues.

Regulatory Scrutiny and Investor Concerns

Ofwat, the water industry regulator, has taken an increasingly firm stance against Thames Water's financial structure and dividend payments to shareholders. The company's owners, including major pension funds and sovereign wealth funds, have expressed frustration with the regulatory environment while simultaneously refusing to inject additional capital.

The situation reached a critical point last month when shareholders unexpectedly withdrew £500 million of emergency funding that had been previously promised, citing Ofwat's "uninvestable" regulatory framework.

What Project Timber Means for Customers

The government's emergency plan would likely see Thames Water placed into a special administration regime, similar to that used for energy supplier Bulb in 2021. This temporary measure would ensure:

- Continuous water supply and wastewater services for millions of households

- Protection of vital infrastructure and operational continuity

- Minimal disruption to customers during the transition period

- Safeguarding of employment for thousands of water company staff

However, experts warn that any form of government intervention could ultimately result in higher bills for consumers, as taxpayers might need to shoulder some financial burden during the stabilisation period.

Broader Implications for UK Water Industry

Thames Water's crisis has exposed fundamental weaknesses in the regulatory model that has governed England's water industry since privatisation in 1989. Several other water companies are also struggling with significant debt levels, raising concerns about sector-wide stability.

MPs on environmental committees have called for urgent reforms to ensure water companies prioritise infrastructure investment and environmental protection over shareholder returns. The Thames Water situation may well become a catalyst for fundamental changes in how essential utilities are regulated in Britain.

As the government and regulators continue their delicate balancing act between protecting consumers and maintaining investor confidence, millions of households await news about the future of their water supply with growing anxiety.