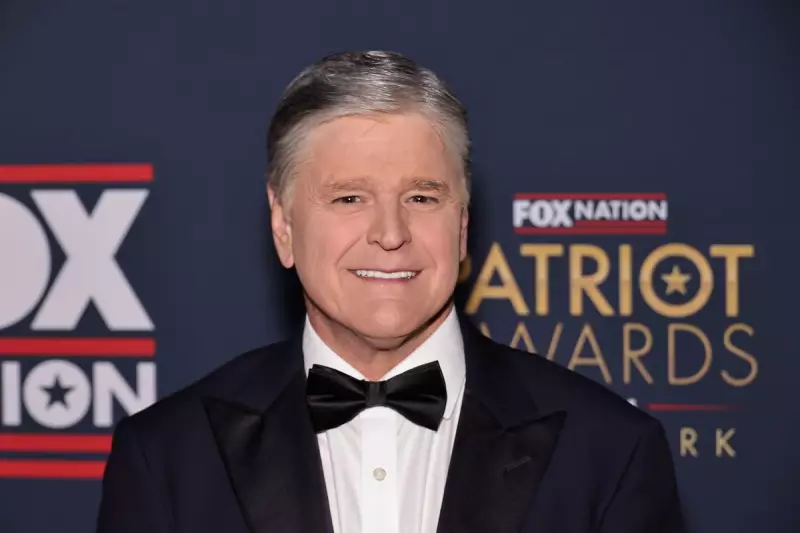

In a move that underscores a growing trend among America's financial and media elite, Fox News Channel's stalwart host, Sean Hannity, has officially swapped the skyscrapers of New York for the sun-drenched shores of Florida.

The conservative commentator, a defining voice on prime-time television, has established legal residency in the Sunshine State, a decision widely interpreted as a strategic manoeuvre to leverage Florida's famously taxpayer-friendly climate. This relocation places him alongside a cadre of high-net-worth individuals and celebrities seeking refuge from the steep income and tax burdens of states like New York and California.

The Financial Driving Force

While Hannity has not publicly elaborated on his motivations, financial experts point to the undeniable fiscal benefits. Florida imposes no state income tax, no state-level inheritance tax, and no estate tax. For a high-earner like Hannity, whose multimillion-dollar contracts with Fox News and syndicated radio are public knowledge, the potential savings amount to a fortune annually.

This stands in stark contrast to New York City, where top earners can face a combined city and state income tax rate nearing 13%, one of the highest in the nation.

A Well-Trodden Path South

Hannity is far from alone in this migration. He joins a significant exodus of prominent figures from the world of finance, media, and entertainment. The list includes fellow Fox personality Jesse Watters, radio host Mark Levin, and countless executives from Wall Street.

This trend has been amplified in recent years, with many citing not only financial advantages but also differences in political climate and overall quality of life as motivating factors for the move.

Life Between Two States

It is important to note that the change to Florida residency is primarily a legal and financial designation. Sean Hannity is expected to maintain a significant presence in New York, where his television show is produced. He will likely utilise a common arrangement where he spends just under half the year in New York to comply with residency laws, while his official 'domicile' for tax purposes is firmly planted in Florida.

This strategic relocation marks a significant personal and financial chapter for one of cable news's most influential figures, emblematic of a broader shift in where America's wealth is choosing to call home.