A historian dedicated to preserving a site where Mary, Queen of Scots was imprisoned has described feeling 'desperate' after becoming the victim of a sophisticated SIM-swap fraud, which saw criminals steal thousands of pounds from his personal and charity accounts.

The Devastating Discovery

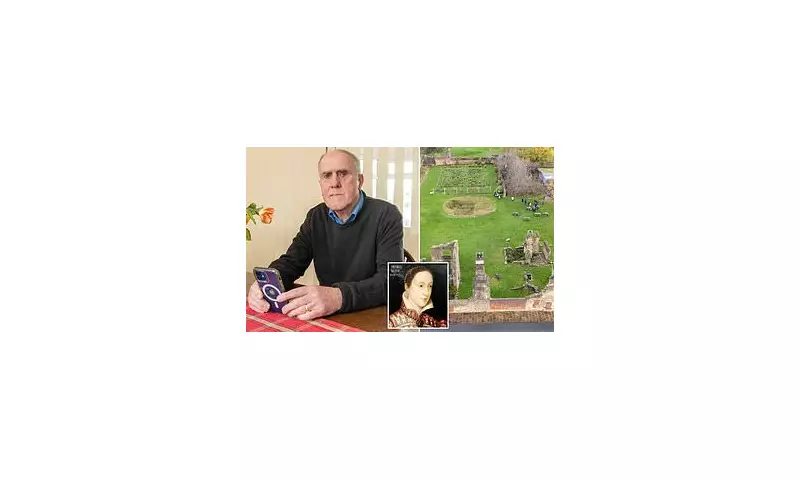

David Templeman, 81, from Derbyshire, first suspected trouble in early October when his mobile phone suddenly stopped working. Initially believing it was a technical fault, the alarming truth emerged when he checked his bank accounts. He discovered that £1,600 had been taken from a shareholding account with Hargreaves Lansdown.

The situation worsened when he examined the finances of the charity he chairs, the Friends of Sheffield Manor Lodge. A further £1,600 was stolen from the charity's HSBC account, sent via four unauthorised direct debit payments to PayPal. An additional £340 was taken from a separate PayPal account used by the charity for ticket sales and donations.

A Historic Site Under Threat

The stolen funds were part of vital donation drives to support Sheffield Manor Lodge. Mary, Queen of Scots was held under house arrest at the estate on the orders of her cousin, Elizabeth I, from 1570 to 1584, spending 14 of her 19 years in captivity there.

The historic Tudor site, including the Turret House, has fallen into disrepair. The charity estimates that between £50,000 and £100,000 is needed for essential renovation work. The theft of these crucial funds was a significant blow to these conservation efforts.

How the SIM-Swap Scam Unfolded

Mr Templeman had fallen victim to a growing crime trend. SIM-swap fraud involves criminals convincing a mobile provider to transfer a victim's phone number to a SIM card they control. This allows them to intercept security texts, including two-factor authentication (2FA) codes, and gain access to bank accounts.

The historian believes the fraud began when his wife, Anne, 79, had her Halifax card declined after suspicious activity was flagged. Shortly after, his phone service was cut off. The scammer had successfully persuaded his network, GiffGaff, to switch his number.

Action Fraud reports that SIM-swap cases have doubled year-on-year, with 2,037 incidents reported by the end of November 2024, up from 1,070 in 2023.

A Battle for Recourse and Resolution

While the money taken from his investment account was swiftly returned after he reported the fraud, recovering the charity's money proved far more difficult. Mr Templeman claimed HSBC directed him to PayPal, and PayPal in turn told him to contact HSBC, leaving him distressed and in limbo.

"They're treating me now as if I'm the fraudster. It's a terrible situation to be in," he said prior to resolution. He argued that HSBC failed in its duty by not flagging the suspicious direct debits set up on an account that was not authorised for such payments.

It was only after the Daily Mail intervened that PayPal re-examined the case. A PayPal spokesperson later confirmed the matter had been "resolved positively," with the stolen funds returned. HSBC UK stated it was sorry Mr Templeman had been scammed and had advised on recovery steps.

The ordeal, which took weeks to resolve fully, highlights the vulnerability of individuals and vital community charities to evolving cybercrime tactics. It serves as a stark warning about the importance of protecting personal data and the challenges victims can face in seeking redress from financial institutions.