From Humble Rental to Multi-Million Dollar Mansion

Anya Phan, 53, and her daughter Thi Ta, 25, have been accused of orchestrating one of the most sophisticated financial fraud schemes ever witnessed in New South Wales. The pair allegedly rose from living in a modest rental property to occupying a $13.75 million mansion in what police describe as a meteoric ascent funded by crime.

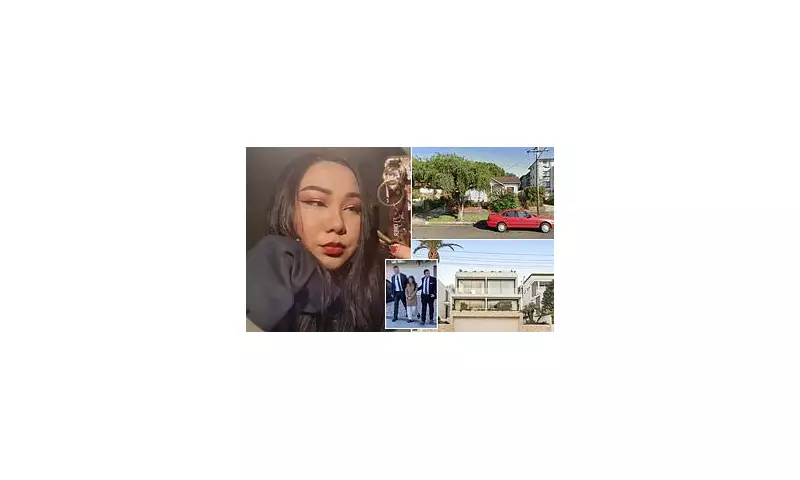

Business records obtained by investigators reveal that as recently as May this year, Phan's registered address was a single-storey rental in Lewisham, located in Sydney's inner west. The four-bedroom property, which last sold for $175,000 in the 1990s, was being rented for $790 per week at the time Phan resided there.

Just weeks later in June, Phan's company purchased the extravagant Dover Heights property approximately 15 kilometres away in Sydney's exclusive eastern suburbs. The luxury residence boasts an indoor cinema, six-person lift, gym, steam room, swimming pool, and sweeping harbour views.

The Alleged Fortune Telling Fraud Operation

Police allege that Phan posed as a feng shui master and psychic, specifically targeting vulnerable members of Sydney's Vietnamese community. She reportedly convinced clients that she could see a 'billionaire' in their future, then coaxed them into taking out loans in their own names.

The scheme allegedly involved Phan pocketing a portion of these loan funds while promising her clients future wealth that never materialised. The total estimated fraud amounts to approximately $70 million obtained from defrauded clients.

Detectives arrested the mother and daughter during an early morning raid at their Dover Heights mansion on Wednesday. During the search, officers seized financial documents, mobile phones, electronics, luxury handbags, a 40-gram gold bar worth about $10,000, and $6,600 in casino chips.

Broader Syndicate Connections and Additional Arrests

The investigation initially focused on fraudulent car financing in January 2024, examining a syndicate allegedly using stolen identities to obtain financing for luxury 'ghost cars' that never existed. The probe has since expanded to uncover large-scale loan fraud across multiple financial institutions.

The so-called 'Penthouse Syndicate' is alleged to have defrauded the National Australia Bank out of more than $150 million over two years, with police alleging up to $250 million was involved across major banks and financiers over a seven-year period.

NAB senior business banking manager Timotius Donny Sungkar, 36, was arrested and charged last week after allegedly facilitating about $10 million in fraudulent loans for the syndicate. Police claim Sungkar was paid $17,000 to approve loans applied for with documents linked to shell companies purchased by the syndicate. He remains in custody facing 19 charges.

Bing 'Michael' Li, 38, was arrested in July at an $18 million penthouse in the Crown residential Barangaroo tower, from where he allegedly directed the syndicate's operations.

Lavish Lifestyle and Legal Consequences

The extravagance allegedly extended beyond property acquisitions. Social media posts show Ta enjoying a jet-setting lifestyle, including a trip around Asia last year with her partner, Jett Griffiths. The couple documented visits to cultural sites throughout China and posed with monkeys during their travels.

Griffiths has not been charged in relation to the alleged fraud scheme and declined to comment on his girlfriend's charges when contacted. Sources close to him indicated he is 'doing fine' given the circumstances.

Financial Crimes Squad Commander Detective Superintendent Gordon Arbinja described the case as revealing one of the most complex operations he has encountered during his career. 'What began as an investigation into fraudulent car financing has expanded,' he stated, noting that his team had 'worked tirelessly' on the investigation.

Seventeen people have previously been charged under Strike Force Myddleton, with $60 million in assets already restrained by the NSW Crime Commission. The latest arrests brought the total value of seized assets to $75 million after an additional $15 million was frozen this week.

Phan faces 39 charges, including knowingly directing the activities of a criminal group, 19 counts of dishonestly obtaining financial advantage by deception and 13 counts of knowingly dealing with proceeds of crime. She was refused bail and her matter was adjourned until 15 January 2026.

Her daughter Ta faces several charges including two counts of dishonestly obtaining financial advantage by deception and recklessly dealing with the proceeds of crime valued at more than $5,000. She was granted conditional bail to appear in Downing Centre Local Court on 23 January 2026.

NSW Crime Commission Executive Director Darren Bennett emphasised that asset recovery remains a key focus for the agency. 'Recovering assets is not just about punishment - it's about restoring confidence and returning value to the people of NSW,' he said. 'Every dollar we recover... can instead be redirected to benefit the community.'