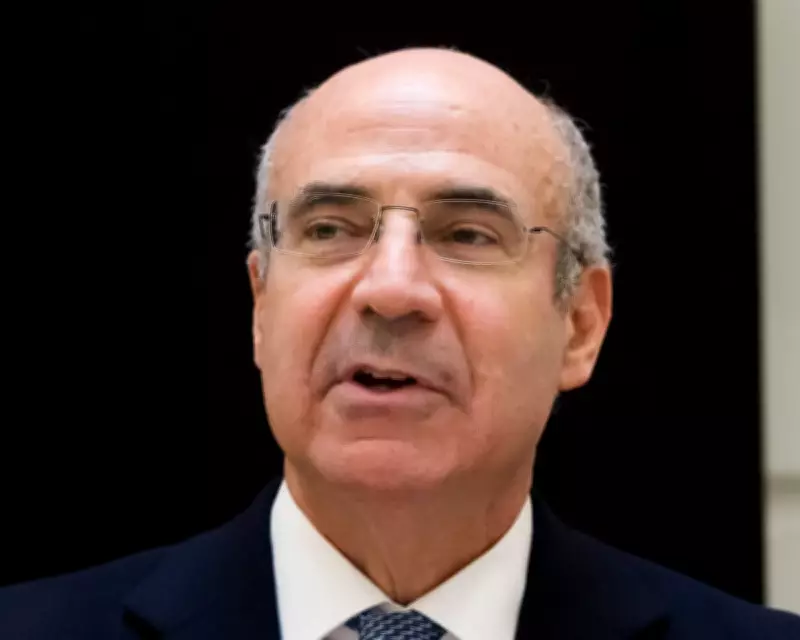

Bill Browder, the well-known financier and anti-corruption activist, has issued a stark warning and a strategic proposal aimed at curtailing the ongoing conflict in Ukraine. He advocates for the imposition of stringent sanctions on refineries across the globe that continue to purchase Russian crude oil, asserting that this measure could significantly undermine Moscow's financial capacity to sustain its military operations.

The Core Argument for Targeting Refineries

In his recent statements, Browder emphasised that while direct sanctions on Russian oil exports have been implemented, a critical loophole remains. Many refineries in various countries are still processing Russian crude, thereby providing a vital revenue stream for the Kremlin. He argues that by extending sanctions to these refineries, the international community could more effectively choke off the funds that fuel Russia's war efforts in Ukraine.

Financial Impact on Russia's War Machine

Browder highlighted that oil and gas revenues constitute a substantial portion of Russia's state budget, estimated to be a primary source of funding for its military expenditures. By targeting refineries, the aim is to disrupt the entire supply chain, making it increasingly difficult for Russia to sell its crude on the global market. This, in turn, could lead to a significant reduction in the financial resources available for the war, potentially forcing Moscow to reconsider its stance.

He pointed out that previous sanctions have had some effect, but they have not been comprehensive enough. The continued operation of refineries buying Russian oil allows Moscow to circumvent restrictions, maintaining a steady flow of income. Browder's proposal seeks to close this gap by holding the refineries accountable, thereby increasing the economic pressure on Russia.

International Response and Challenges

The call for such sanctions comes amid ongoing debates within the international community about the most effective ways to support Ukraine and deter Russian aggression. Browder's suggestion aligns with broader efforts to use economic tools as a means of conflict resolution, but it also faces potential hurdles.

Implementing these sanctions would require coordinated action among multiple nations, some of which may have economic ties to Russian oil. There could be resistance from countries that rely on Russian crude for their energy needs, posing challenges to achieving a unified global stance. However, Browder argues that the moral imperative to end the war and support Ukrainian sovereignty should outweigh these economic considerations.

Broader Implications for Global Energy Markets

If adopted, Browder's proposal could have far-reaching consequences for global energy markets. It might lead to shifts in oil trading patterns, with refineries seeking alternative sources of crude to avoid sanctions. This could potentially drive up prices or cause supply disruptions in the short term, but Browder contends that such economic adjustments are a necessary sacrifice in the pursuit of peace and stability.

He also noted that this approach could set a precedent for using targeted sanctions in future conflicts, reinforcing the role of financial measures in international diplomacy. By focusing on specific entities like refineries, it aims to minimise broader economic fallout while maximising pressure on the aggressor state.

Conclusion: A Call to Action

In summary, Bill Browder's advocacy for sanctions on refineries purchasing Russian crude oil represents a strategic effort to leverage economic pressure to help end the war in Ukraine. By cutting off a key revenue stream for Moscow, he believes the international community can play a pivotal role in de-escalating the conflict and supporting a peaceful resolution. As the war continues, his proposal adds to the ongoing discourse on how best to utilise financial tools in the service of global security and humanitarian goals.