The fitness world in Melbourne has been rocked by the sudden and dramatic collapse of the Derrimut 24/7 gym chain, a enterprise once linked to the flamboyant 'mystery box' buyer and social media personality, Adrian Portelli.

Administrators from Worrells Solvency & Forensic Accountants were appointed to a staggering 18 companies within the group, revealing a financial black hole with creditors potentially facing losses of up to $10 million. The gyms have been abruptly shuttered, leaving thousands of paid-up members in the lurch and staff without jobs.

A Tangled Web of Companies and Debt

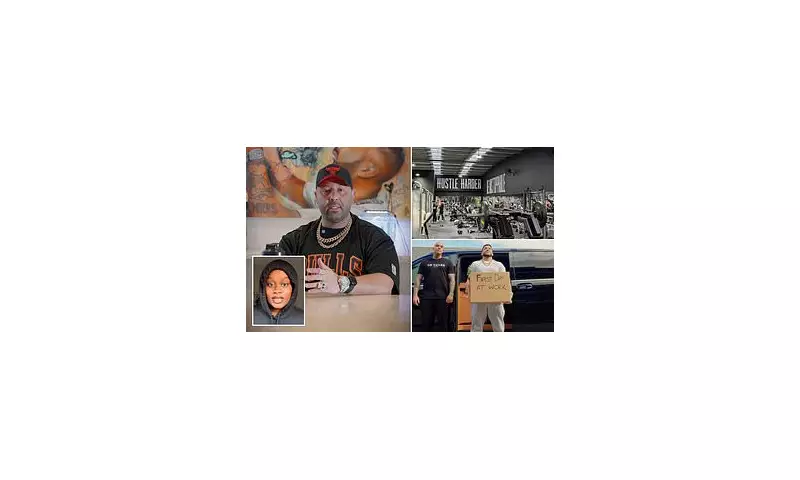

The corporate structure behind Derrimut 24/7 is complex. While Adrian Portelli's name has been synonymous with the brand's publicity, the companies placed into liquidation are primarily controlled by his business partner, Zoran Krajinic. The administrators are now untangling a web of intercompany loans and significant debts owed to the Australian Taxation Office (ATO) and other creditors.

Key financial revelations include:

- Unsecured creditors are estimated to be owed between $5 million and $10 million.

- A significant debt is owed to the ATO.

- Member pre-paid fees, potentially amounting to hundreds of thousands of dollars, are likely lost.

Members Left High and Dry

The most immediate impact is on the gym's members. Many paid for annual memberships in advance, lured by discounted rates, and now face the prospect of receiving no service and no refund. The administrators have confirmed that members, considered unsecured creditors, are unlikely to recoup their money.

Social media has been flooded with angry posts from former members feeling betrayed, while staff have been left unemployed with unpaid wages and entitlements, adding a human cost to the financial collapse.

The Adrian Portelli Connection

Adrian Portelli, known for his lavish spending on luxury cars and high-profile real estate, had been a public face for the gym chain. However, the administrators note that his direct involvement in the liquidated companies appears limited. The situation raises questions about the separation between personal brand and business liabilities, a common pitfall for celebrity-backed ventures.

What Happens Next?

The liquidation process will focus on selling any remaining assets of the gyms, such as equipment, to repay creditors as much as possible. A creditors' meeting will be held to vote on the future of the process. For the thousands of affected members, the experience serves as a stark warning about the risks of pre-paying for services with businesses that may not have sustainable financial foundations.