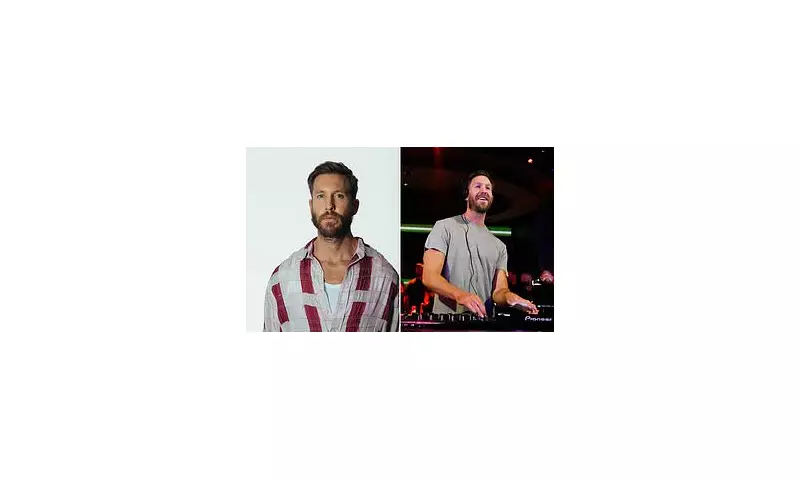

Global music superstar Calvin Harris has plunged into a bitter legal dispute with his former financial advisor, alleging a staggering £22.5 million was embezzled from a doomed Hollywood property venture.

The Scottish DJ and producer, whose real name is Adam Wiles, has filed a bombshell lawsuit in Los Angeles Superior Court. The legal documents claim his ex-business manager, Jonathan Walton, and his firm, Walton International Management, orchestrated a complex scheme to divert funds meant for a high-end real estate project.

The Lavish Plan That Turned Sour

The suit details a grand plan to develop a luxurious residential and commercial property in a prime Los Angeles location. Harris, 40, allegedly invested the multi-million pound sum based on Walton's advice and projections. However, the project is described as a complete "boondoggle"—a wasteful failure that ultimately collapsed.

Central to the allegations is the claim that Walton:

- Misappropriated funds for personal and unauthorized uses.

- Provided false account statements and reports to conceal the missing money.

- Breached his fiduciary duty by failing to act in his client's best interests.

A Severe Breach of Trust

This case highlights the immense trust celebrities place in their financial teams and the potential vulnerabilities they face. Harris, one of the world's highest-paid DJs, is seeking full restitution of the lost funds, plus substantial damages for fraud, negligence, and breach of contract.

The lawsuit suggests the financial advisor exploited his position of trust, leaving the music mogul millions out of pocket. This serves as a stark warning to high-net-worth individuals about the critical importance of financial oversight.

As the case unfolds in a Californian court, the entertainment and business worlds are watching closely. This scandal underscores the darker side of celebrity wealth management and the dramatic fallout when that trust is shattered.