The British economy is teetering on the brink of a severe crisis as government borrowing costs have surged to their highest level in over a decade, triggering alarm across financial markets and Whitehall.

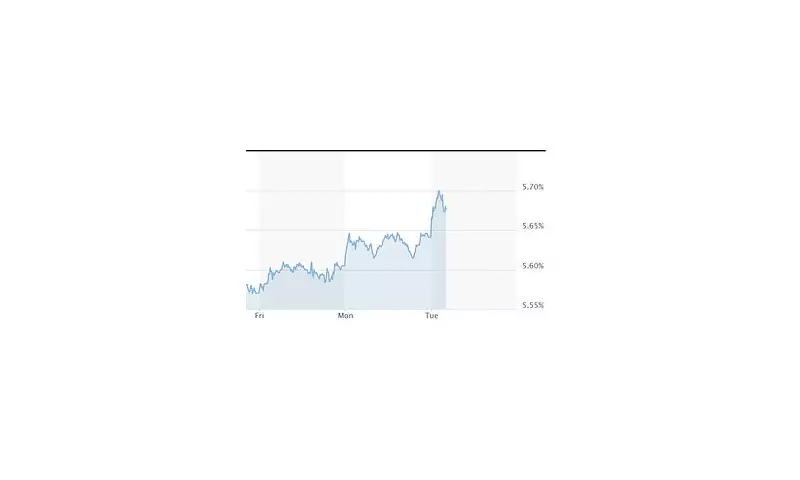

The yield on 10-year UK government bonds, a critical benchmark for state borrowing costs, has soared past 4.2% - a level not seen since the chaotic aftermath of Liz Truss's mini-budget. This dramatic spike has raised serious concerns about the country's ability to manage its growing debt burden.

Market Turmoil and Political Pressure

Chancellor Rachel Reeves now faces her first major economic storm just weeks into the job, with financial markets delivering a brutal verdict on Britain's fiscal health. The surge in gilt yields means the government will pay billions more to service the national debt, potentially forcing painful spending cuts or tax rises.

The timing couldn't be worse for Prime Minister Keir Starmer, who has just conducted a significant cabinet reshuffle. The move, intended to strengthen his team's economic credentials, appears to have done little to reassure nervous investors.

Bank of England in the Hot Seat

All eyes are now on the Bank of England as policymakers grapple with stubborn inflation while trying to avoid plunging the economy into deeper trouble. The central bank faces an impossible balancing act: continue raising interest rates to combat inflation or pause to prevent further damage to growth.

Financial experts warn that the UK is particularly vulnerable due to its high levels of household debt and reliance on foreign investment to fund its current account deficit. The pound has also come under pressure, falling against both the dollar and euro.

What This Means for Britain

The consequences for ordinary Britons could be severe:

- Higher mortgage rates as lenders pass on increased borrowing costs

- Tighter government spending on public services like NHS and education

- Reduced business investment as companies face higher financing costs

- Potential tax increases to cover the growing debt interest bill

This developing economic drama represents the first major test for Labour's economic team and could define Chancellor Reeves's reputation in the Treasury. With markets remaining jittery and economic indicators flashing warning signs, the government has little room for error in navigating this crisis.