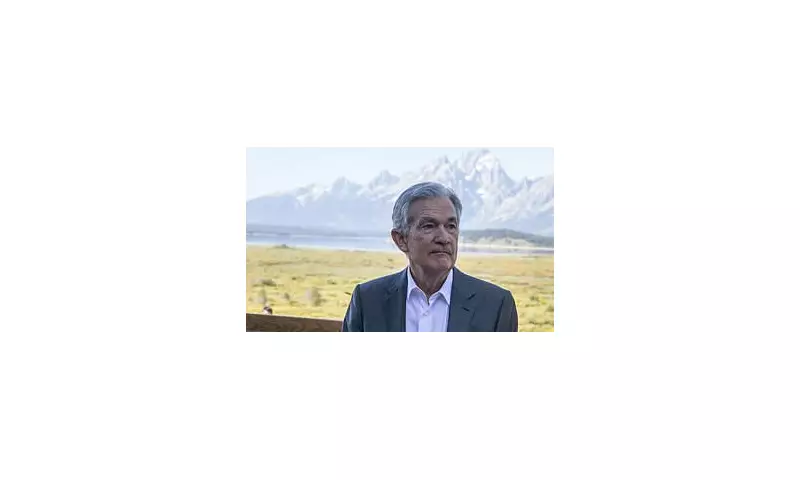

In a move that sent ripples across global markets, Federal Reserve Chair Jerome Powell has firmly pressed pause on any immediate interest rate cuts, holding the US benchmark at a 23-year high. The decision underscores a starkly more cautious approach from the world's most influential central bank as it continues its protracted battle against stubborn inflation.

A Hawkish Hold Sends Shockwaves

The Federal Open Market Committee (FOMC) voted unanimously to maintain the key federal funds rate within the range of 5.25% to 5.5%, a level untouched since July 2023. This 'hawkish hold' was widely anticipated by economists, but the real surprise lay in the Committee's updated economic projections.

Powell and his colleagues now foresee just a single quarter-point rate cut before the end of the year, a significant retreat from the three cuts projected back in March. This dramatic shift in tone signals a deepening concern that the 'last mile' of bringing inflation down to the Fed's 2% target is proving far more difficult than expected.

The Inflation Conundrum

The Fed's more guarded stance is a direct response to a string of disappointing inflation readings in the first quarter of 2024. While price pressures have cooled significantly from their peak, recent data has shown a worrying lack of progress.

'We'll need to see more good data to bolster our confidence that inflation is moving sustainably toward 2%,' stated a resolute Powell in his post-meeting press conference. He emphasised that the central bank is committed to making decisions 'meeting by meeting,' and would not be rushed into easing policy prematurely.

Market Reaction and Global Implications

The announcement immediately strengthened the US dollar and pushed Treasury yields higher, as traders swiftly adjusted their bets for a slower easing cycle. The policy stance from the Fed has profound implications for other major central banks, including the Bank of England.

The Old Lady of Threadneedle Street, which announces its own decision today, now faces a more complex backdrop. A more hawkish Fed provides cover for the Monetary Policy Committee to also take its time, potentially delaying a first UK rate cut that markets had been eagerly pricing in for the summer.

What's Next for Borrowers and Savers?

For millions on both sides of the Atlantic, the Fed's patience means continued financial pressure. Mortgage rates, credit card APRs, and loan costs are likely to remain elevated for longer. Conversely, savers will benefit from higher returns on cash deposits and savings accounts persisting well into the future.

All eyes now turn to the incoming economic data. The Fed has made it clear that the path forward is entirely data-dependent. Any signs of a cooling labour market or a decisive drop in inflation could reopen the door to cuts sooner than expected. For now, however, Powell's message is one of unwavering caution.